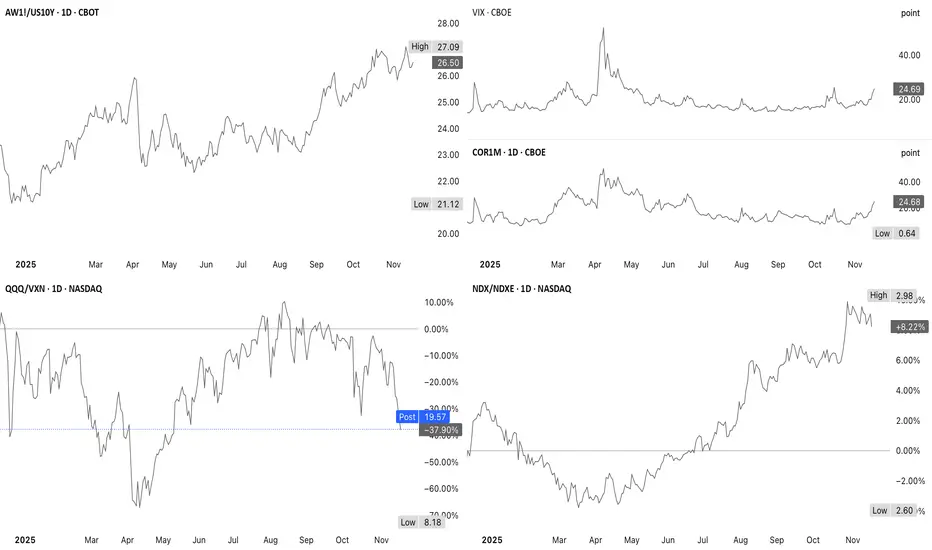

1. AW1!/US10Y shows commodities trending higher

2. VIX & COR1M shows volatility is high

3. QQQ/VXN is still extremely washed-out

4. NDX/NDXE shows breadth remains strong

This is event-driven fear layered on top of a still-healthy breadth structure

A rebound toward $610-$620 remains the more probable post-NVDA path

QQQ

QQQ  SPY

SPY  NVDA

NVDA

- A rising broad commodity index means inflationary pressure is accelerating & this tends to push yields up, which pressures tech multiples

- Higher commodity prices is a drag on QQQ

2. VIX & COR1M shows volatility is high

- COR1M ripping harder than VIX indicates front-loaded hedging & is event-driven

- After NVDA earnings, volatility normally compresses sharply unless the event is disastrous

- This is supportive for a post-event equity bounce

3. QQQ/VXN is still extremely washed-out

- QQQ underperforming implied volatility by a wide margin is historically associated with short-term exhaustion lows

- This extreme is more consistent with fear/hedging overshoot

- This favors a bounce unless VXN continues ripping

4. NDX/NDXE shows breadth remains strong

- Even with commodities rising (inflation pressure), equal-weight Nasdaq is firmly outperforming

- When inflation becomes a serious tech headwind, breadth usually collapses, not expands

- Breadth made higher highs, is still in an uptrend & turned bearish

This is event-driven fear layered on top of a still-healthy breadth structure

- NVDA event hedging elevates COR1M/VIX, QQQ dips into support ($598-$602)

- Volatility crush after earnings if NVDA isn’t disastrous results in a bounce toward $610-$620; however, rising commodities means the upside is less explosive & may fade sooner

A rebound toward $610-$620 remains the more probable post-NVDA path

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.