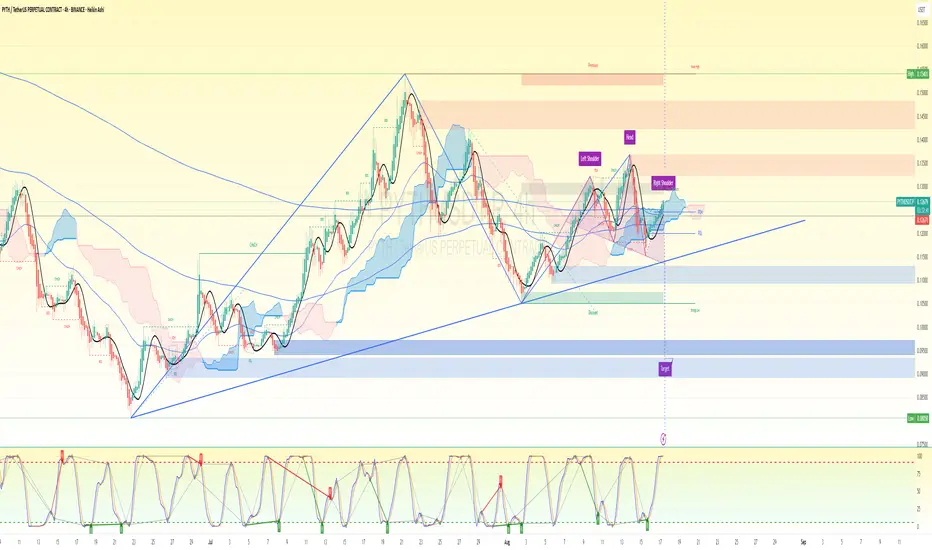

🔎 Chart Context

Pattern: A clear Head & Shoulders (H&S) structure has formed. Price is testing the neckline area (~0.126–0.128).

Indicators:

Stochastic RSI is pushing up from oversold → suggesting temporary relief rally.

Price is still inside/near the cloud resistance zone (bearish bias).

Target Zone: Marked at 0.090–0.095, aligning with the measured H&S breakdown.

📍 Precise Sniper Setup

Bias: Bearish (most probable continuation setup).

Entry (Short):

Aggressive: 0.1265 – 0.1280 (current price + neckline retest zone).

Conservative: Wait for a 4h close below 0.1230 (clean neckline break confirmation).

Stop-Loss (SL):

Above Right Shoulder high ~0.1315.

Safer SL: 0.1330 (above liquidity sweep zone).

Take-Profit (TP):

TP1: 0.1150 (near PDL / liquidity pocket).

TP2: 0.1050 (discount zone).

TP3 (Full H&S target): 0.090–0.095 range (your chart’s marked target).

⏳ Estimated Timeframe

If neckline breaks cleanly, TP1–TP2 can be reached in 2–4 days.

Full H&S target (~0.090) could take 5–10 days depending on momentum/volume.

✅ Summary (No bias):

Most probable trade = short from neckline zone (0.126–0.128) with SL above 0.1330 and targets down to 0.095.

If bulls reclaim and hold above 0.1330, the bearish setup is invalidated and shift to neutral → potential upside squeeze into 0.137–0.140.

Pattern: A clear Head & Shoulders (H&S) structure has formed. Price is testing the neckline area (~0.126–0.128).

Indicators:

Stochastic RSI is pushing up from oversold → suggesting temporary relief rally.

Price is still inside/near the cloud resistance zone (bearish bias).

Target Zone: Marked at 0.090–0.095, aligning with the measured H&S breakdown.

📍 Precise Sniper Setup

Bias: Bearish (most probable continuation setup).

Entry (Short):

Aggressive: 0.1265 – 0.1280 (current price + neckline retest zone).

Conservative: Wait for a 4h close below 0.1230 (clean neckline break confirmation).

Stop-Loss (SL):

Above Right Shoulder high ~0.1315.

Safer SL: 0.1330 (above liquidity sweep zone).

Take-Profit (TP):

TP1: 0.1150 (near PDL / liquidity pocket).

TP2: 0.1050 (discount zone).

TP3 (Full H&S target): 0.090–0.095 range (your chart’s marked target).

⏳ Estimated Timeframe

If neckline breaks cleanly, TP1–TP2 can be reached in 2–4 days.

Full H&S target (~0.090) could take 5–10 days depending on momentum/volume.

✅ Summary (No bias):

Most probable trade = short from neckline zone (0.126–0.128) with SL above 0.1330 and targets down to 0.095.

If bulls reclaim and hold above 0.1330, the bearish setup is invalidated and shift to neutral → potential upside squeeze into 0.137–0.140.

Trading ditutup: target tercapai

Target 1 achieved. Catatan

TP 2 LoadingPernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.