Primary Elliott Wave Scenario –  NVO

NVO

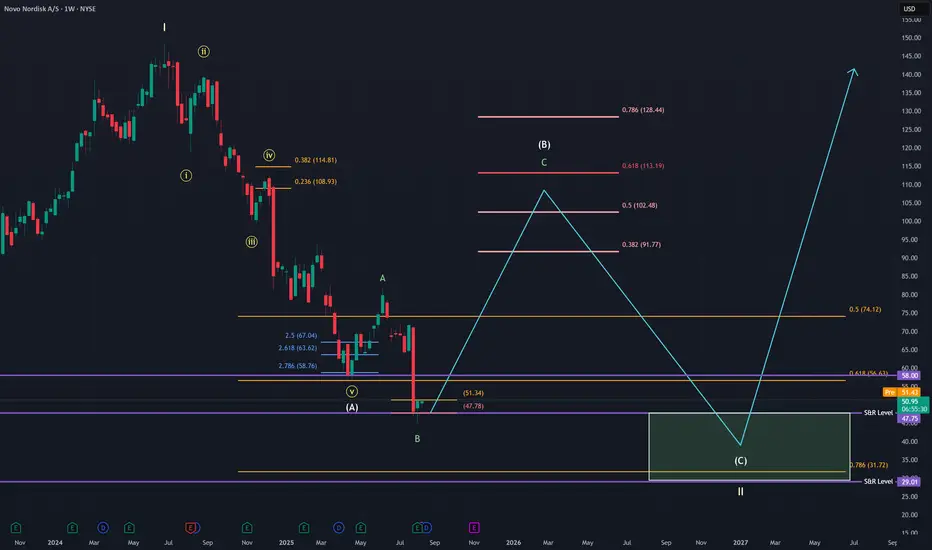

I believe NVO completed a multi-year Wave I in May 2024. Since then, we’ve seen the A-wave of a larger ABC correction play out.

NVO completed a multi-year Wave I in May 2024. Since then, we’ve seen the A-wave of a larger ABC correction play out.

The price dipped below the 0.618 Fib at $56.63, but reclaimed key support at $47.75. My current primary count suggests that the bottom might already be in.

The drop to $45 looks like an extended B-wave, hitting classic Fibonacci targets.

If the bottom is confirmed, I expect a B-wave rally with a likely target range of $91.77–$113.19 — possibly even higher.

This is not a short-term move; it will take time to develop.

After the B-wave completes, I anticipate a final C-wave down to $47.75–$29, which would complete the Wave II correction.

This would set up a major long-term buying opportunity for the years ahead.

Invalidation:

If price breaks below $45 again, this scenario is invalid. In that case, we likely head straight to $32 and the 0.786 Fib.

I believe

The price dipped below the 0.618 Fib at $56.63, but reclaimed key support at $47.75. My current primary count suggests that the bottom might already be in.

The drop to $45 looks like an extended B-wave, hitting classic Fibonacci targets.

If the bottom is confirmed, I expect a B-wave rally with a likely target range of $91.77–$113.19 — possibly even higher.

This is not a short-term move; it will take time to develop.

After the B-wave completes, I anticipate a final C-wave down to $47.75–$29, which would complete the Wave II correction.

This would set up a major long-term buying opportunity for the years ahead.

Invalidation:

If price breaks below $45 again, this scenario is invalid. In that case, we likely head straight to $32 and the 0.786 Fib.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.