😎 NVDA Thief’s Wealth Heist: Swing/Day Trade Blueprint 🚀

Asset: NVIDIA Corporation (NVDA) 📈Vibe: Bullish, sneaky, and ready to snatch profits with style! 💰

Welcome, ladies and gentlemen, to the Thief’s OG Wealth Strategy Map for NVDA!

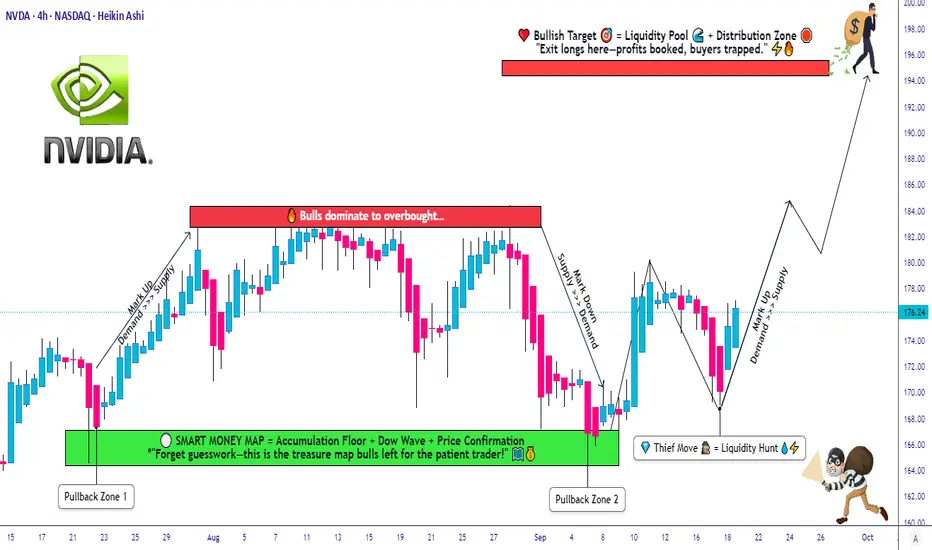

This is a fun swing/day trading plan designed to grab liquidity like a master thief. Let’s break down this bullish setup with a double bottom pullback, layered entries, and a cheeky escape plan. Ready to outsmart the market? 🕵️♂️

📊 Market Analysis: Why NVDA?

NVDA is riding a bullish wave 🌊, confirmed by a double bottom pullback pattern and a sneaky liquidity grab at key support levels. The stock’s momentum is screaming “UP!” as buyers step in to defend the price. This setup is perfect for swing or day traders looking to capitalize on NVIDIA’s tech-fueled surge. 💻

🗺️ The Thief’s Plan: Bullish Heist Strategy

🎯 Entry Strategy:Deploy the Thief’s Layering Tactic with multiple buy limit orders to maximize your entry precision.

Suggested price levels:

$172.00

$174.00

$176.00

$178.00

Pro Tip: Feel free to add more layers based on your risk appetite and market conditions. The more, the merrier! 🧑💼

🛑 Stop Loss (SL):Set a Thief’s SL at $168.00 to protect your loot.

Note: Dear Thief OGs, this SL is my suggestion, but you’re the boss of your trades! Adjust based on your risk tolerance and let the profits roll. 💸

🎉 Take Profit (TP):Aim for the juicy $195.00 target, where we expect strong resistance, potential overbought conditions, and a possible trap for the unprepared. Lock in those hard-earned gains and escape like a pro! 🏃♂️

Note: This TP is my call, but you do you! Take profits at your own pace and keep the cash flowin’. 😎

🔗 Related Pairs to Watch (in USD)

To boost your market awareness, keep an eye on these correlated assets:

AMD (Advanced Micro Devices): NVDA’s chipmaking cousin often moves in tandem. A bullish NVDA could signal strength in AMD. 📡

AMD (Advanced Micro Devices): NVDA’s chipmaking cousin often moves in tandem. A bullish NVDA could signal strength in AMD. 📡

SMH (VanEck Semiconductor ETF): This ETF tracks the semiconductor sector, including NVDA. Watch for sector-wide momentum. 📊

SMH (VanEck Semiconductor ETF): This ETF tracks the semiconductor sector, including NVDA. Watch for sector-wide momentum. 📊

QQQ (Invesco QQQ Trust): NVDA’s a heavy hitter in this tech-heavy ETF. QQQ’s trend can confirm NVDA’s direction. 🚀

QQQ (Invesco QQQ Trust): NVDA’s a heavy hitter in this tech-heavy ETF. QQQ’s trend can confirm NVDA’s direction. 🚀

Key Correlation Point: NVDA’s performance is tied to the broader semiconductor and tech sector. If AMD or SMH shows bullish patterns, it reinforces NVDA’s upside potential. Conversely, weakness in QQQ could signal caution. Stay sharp, thieves! 🕵️

🛠️ Why This Setup Rocks

Double Bottom Pullback: A textbook bullish reversal pattern, signaling strong buying interest. 📉➡️📈

Liquidity Grab: The market’s attempt to shake out weak hands before the real move up. We’re smarter than that! 😏

Layered Entries: Spread your risk across multiple price levels for a smoother ride. 🎢

Risk Management: Clear SL and TP levels keep your heist disciplined and profitable. 🧠

⚠️ Disclaimer

This Thief Style Trading Strategy is just for fun and educational purposes! I’m not a financial advisor, and trading involves risks. Make your own decisions, manage your risk, and trade responsibly. Let’s keep the vibes high and the losses low! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NVIDIA #NVDA #Trading #SwingTrading #DayTrading #ThiefStrategy #StockMarket #Bullish #TechnicalAnalysis

Asset: NVIDIA Corporation (NVDA) 📈Vibe: Bullish, sneaky, and ready to snatch profits with style! 💰

Welcome, ladies and gentlemen, to the Thief’s OG Wealth Strategy Map for NVDA!

This is a fun swing/day trading plan designed to grab liquidity like a master thief. Let’s break down this bullish setup with a double bottom pullback, layered entries, and a cheeky escape plan. Ready to outsmart the market? 🕵️♂️

📊 Market Analysis: Why NVDA?

NVDA is riding a bullish wave 🌊, confirmed by a double bottom pullback pattern and a sneaky liquidity grab at key support levels. The stock’s momentum is screaming “UP!” as buyers step in to defend the price. This setup is perfect for swing or day traders looking to capitalize on NVIDIA’s tech-fueled surge. 💻

🗺️ The Thief’s Plan: Bullish Heist Strategy

🎯 Entry Strategy:Deploy the Thief’s Layering Tactic with multiple buy limit orders to maximize your entry precision.

Suggested price levels:

$172.00

$174.00

$176.00

$178.00

Pro Tip: Feel free to add more layers based on your risk appetite and market conditions. The more, the merrier! 🧑💼

🛑 Stop Loss (SL):Set a Thief’s SL at $168.00 to protect your loot.

Note: Dear Thief OGs, this SL is my suggestion, but you’re the boss of your trades! Adjust based on your risk tolerance and let the profits roll. 💸

🎉 Take Profit (TP):Aim for the juicy $195.00 target, where we expect strong resistance, potential overbought conditions, and a possible trap for the unprepared. Lock in those hard-earned gains and escape like a pro! 🏃♂️

Note: This TP is my call, but you do you! Take profits at your own pace and keep the cash flowin’. 😎

🔗 Related Pairs to Watch (in USD)

To boost your market awareness, keep an eye on these correlated assets:

Key Correlation Point: NVDA’s performance is tied to the broader semiconductor and tech sector. If AMD or SMH shows bullish patterns, it reinforces NVDA’s upside potential. Conversely, weakness in QQQ could signal caution. Stay sharp, thieves! 🕵️

🛠️ Why This Setup Rocks

Double Bottom Pullback: A textbook bullish reversal pattern, signaling strong buying interest. 📉➡️📈

Liquidity Grab: The market’s attempt to shake out weak hands before the real move up. We’re smarter than that! 😏

Layered Entries: Spread your risk across multiple price levels for a smoother ride. 🎢

Risk Management: Clear SL and TP levels keep your heist disciplined and profitable. 🧠

⚠️ Disclaimer

This Thief Style Trading Strategy is just for fun and educational purposes! I’m not a financial advisor, and trading involves risks. Make your own decisions, manage your risk, and trade responsibly. Let’s keep the vibes high and the losses low! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#NVIDIA #NVDA #Trading #SwingTrading #DayTrading #ThiefStrategy #StockMarket #Bullish #TechnicalAnalysis

Trade aktif

🔍 Fundamental Analysis (FA)This analysis assesses NVIDIA's financial health and intrinsic value based on its business performance.

Financial Health: NVIDIA is a financial powerhouse. Its trailing twelve-month revenue is $165.22 billion, with a net income of $86.6 billion, resulting in an exceptional profit margin of 52.41%. Its operating margin is equally impressive at 60.84% .

Company Value: The current market capitalization is approximately $4.4 Trillion . Based on fundamental valuation models, the calculated intrinsic value of the stock is $139.56 USD, suggesting the stock is currently overvalued by 22% at its last close .

Key Metrics: The Trailing P/E ratio is 53.81, and the Forward P/E is 29.94 .

📰 Catalyst & News-Driven Analysis

Recent news provides clear catalysts that could influence NVIDIA's stock price.

Strategic Investment in xAI: NVIDIA has confirmed a $2 billion investment in Elon Musk's xAI. This partnership secures long-term demand for its GPUs, as xAI plans to build a data center with 200,000 NVIDIA Blackwell GPUs .

Expansion into New Markets: The U.S. government has granted NVIDIA a license to export high-end AI chips (up to 500,000 units per year) to the United Arab Emirates (UAE). This opens a lucrative new revenue stream and strengthens its geopolitical position .

Positive Analyst Action: HSBC upgraded NVIDIA to "Buy" from "Hold," raising its price target to $320. The analyst expects AI chip demand to grow beyond big tech companies, leading to "continuous earnings growth" .

🌡️ Market Sentiment & Trader Positioning

This section covers the overall mood and positioning of investors.

Retail and Institutional Sentiment: Specific, real-time data on retail and institutional trader sentiment for NVIDIA stock is not available in the search results.

Trading ditutup: target tercapai

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.