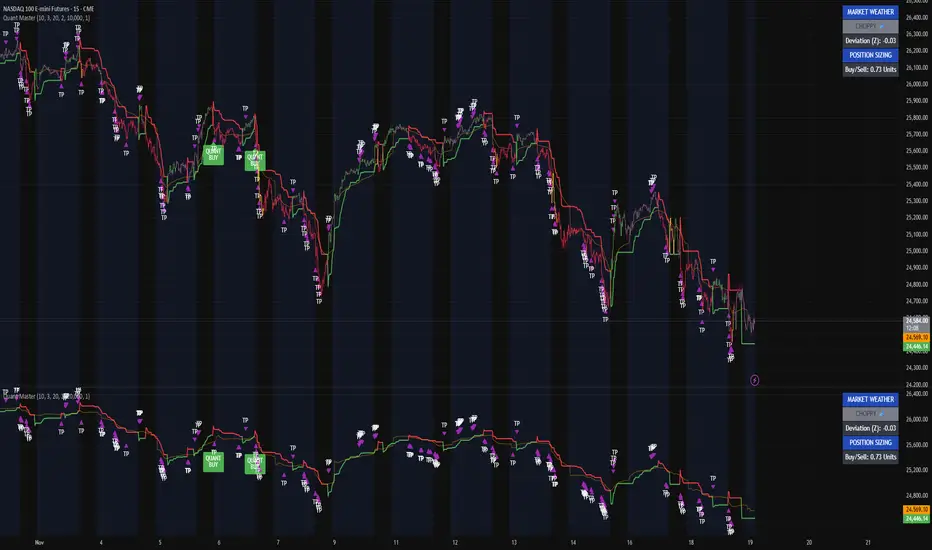

I’m tracking NASDAQ 100 e-mini futures (NQ) on the 15-minute using my Quant Master Trend System — the same model I use to separate real directional pressure from intraday noise.

This entire chart is a perfect example of why most traders get chopped to death: they trade emotions, but I trade structure.

The ribbon is choppy, fragmented, and constantly flipping, which is exactly what I expect when Market Weather is labeled CHOPPY in the panel.

That mode tells me one thing:

Breakouts fail.

Breakdowns fail.

Momentum has no conviction.

When the system is in CHOPPY mode, every pullback looks like a setup, but it’s not — the model purposely suppresses continuation trades and fires more TP clusters because it’s detecting distribution, not trend.

You can see it clearly:

• Every time the ribbon tries to go green, it gets rejected within a handful of bars.

• Every red flip lacks strong downside extension — everything fizzles.

• Price oscillates around the volatility stop instead of respecting it.

• TP clusters fire rapidly — that’s your model’s “don’t trust this move” signature.

Even the Quant Buy signals tell the story.

They’re valid moves, but they’re short-lived, because the underlying pressure isn’t unified. That’s the entire point of this system: it’s telling you the environment, not just the direction.

The deviation reading is mild at Z ≈ -0.38, which means price isn’t stretched in either direction — the perfect recipe for messy intraday action.

So here’s how I’m interpreting this:

This is not a trending environment.

This is rotational flow, liquidity probing both sides, and no clean edge.

The ribbon’s behavior, the failed retests, the compression, and the constant TP firing confirm that NQ is stuck in a structure where continuation trades have the lowest probability.

Until Market Weather leaves CHOPPY and we get a clean ribbon alignment, I’m treating everything as low conviction and short-duration.

This entire chart is a perfect example of why most traders get chopped to death: they trade emotions, but I trade structure.

The ribbon is choppy, fragmented, and constantly flipping, which is exactly what I expect when Market Weather is labeled CHOPPY in the panel.

That mode tells me one thing:

Breakouts fail.

Breakdowns fail.

Momentum has no conviction.

When the system is in CHOPPY mode, every pullback looks like a setup, but it’s not — the model purposely suppresses continuation trades and fires more TP clusters because it’s detecting distribution, not trend.

You can see it clearly:

• Every time the ribbon tries to go green, it gets rejected within a handful of bars.

• Every red flip lacks strong downside extension — everything fizzles.

• Price oscillates around the volatility stop instead of respecting it.

• TP clusters fire rapidly — that’s your model’s “don’t trust this move” signature.

Even the Quant Buy signals tell the story.

They’re valid moves, but they’re short-lived, because the underlying pressure isn’t unified. That’s the entire point of this system: it’s telling you the environment, not just the direction.

The deviation reading is mild at Z ≈ -0.38, which means price isn’t stretched in either direction — the perfect recipe for messy intraday action.

So here’s how I’m interpreting this:

This is not a trending environment.

This is rotational flow, liquidity probing both sides, and no clean edge.

The ribbon’s behavior, the failed retests, the compression, and the constant TP firing confirm that NQ is stuck in a structure where continuation trades have the lowest probability.

Until Market Weather leaves CHOPPY and we get a clean ribbon alignment, I’m treating everything as low conviction and short-duration.

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.