Pembelian

NMR Coin Numeraire Token Prediction and Technical Analysis

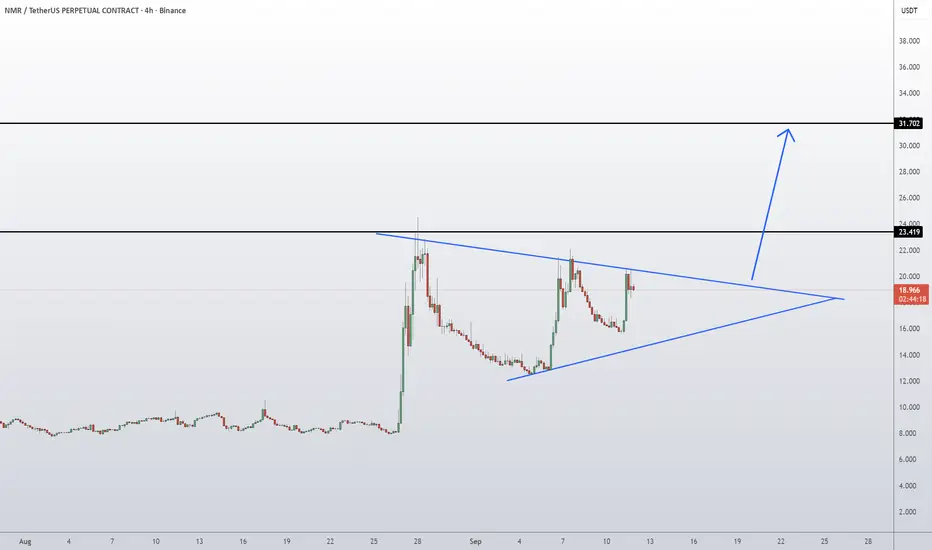

NMR/USDT is currently consolidating inside a symmetrical triangle pattern, showing compression after the explosive move at the end of August. Price is coiling between rising support and descending resistance, preparing for a breakout. A bullish breakout above 23.419 resistance would likely trigger strong continuation toward the 31.702 zone. On the flip side, failure to hold the triangle support could send price back into the mid-range before any recovery attempt.

📈 Key Levels:

Buy trigger: Break and hold above 23.419 resistance

Buy zone: 18.00 – 19.20 (pre-breakout positioning inside triangle)

Target 1: 23.419 breakout zone

Target 2: 31.702 resistance

Invalidation: Breakdown below triangle support (~17.00) would weaken the bullish structure

👉 Follow me for More Real Time Opportunities.

Share your Thoughts if you have any?

📈 Key Levels:

Buy trigger: Break and hold above 23.419 resistance

Buy zone: 18.00 – 19.20 (pre-breakout positioning inside triangle)

Target 1: 23.419 breakout zone

Target 2: 31.702 resistance

Invalidation: Breakdown below triangle support (~17.00) would weaken the bullish structure

👉 Follow me for More Real Time Opportunities.

Share your Thoughts if you have any?

👉 FREE Telegram Channel for Daily Updates: ► t.me/supertradeish

👉 VIP Telegram Signals ► t.me/supertradeishsupport

👉 VIP Telegram Signals ► t.me/supertradeishsupport

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

👉 FREE Telegram Channel for Daily Updates: ► t.me/supertradeish

👉 VIP Telegram Signals ► t.me/supertradeishsupport

👉 VIP Telegram Signals ► t.me/supertradeishsupport

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.