NIO Earnings (QS V3 | 2025-11-24)

Strategy: Buy Calls (Earnings Play)

Confidence: 65% (Medium)

Expiry: 2025-11-28

Strike: $6.00

Entry: ~$0.18

Target 1: $0.36

Stop Loss: $0.09

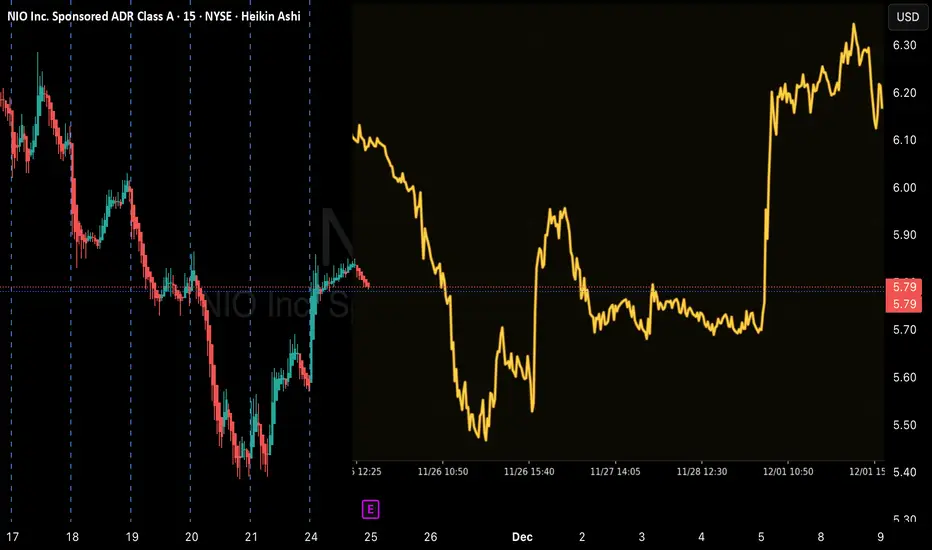

📈 Technical Overview

Price: ~$5.82

Range: $5.25 – $5.87 (tight)

RSI: ~22.4 → Oversold

Volume: 1.1× average → Mild interest

Trend Regime: 95.3% → Strong momentum environment

Support: $5.75 (critical – Katy target)

Resistance: $6.00 / $6.12

IV: ~108% → High earnings volatility

Chart Instructions:

Draw support at $5.75.

Draw resistance line at $6.00–$6.12.

Add RSI indicator (watch for >30 breakout).

Mark option entry zone at $0.18–$0.19.

Plot targets $0.36 and $0.54 (extension).

📰 Sentiment / News Summary

High-impact earnings scheduled

Revenue growth reported at 22,347%

Neutral-to-bullish media tone

Whale activity + call volume shows positioning ahead of earnings

🧪 Flow & Volatility

Put/Call Ratio: 0.37 → Strong call buying

Unusual volume at $6C

Elevated IV ~108% (expect wide moves)

High trend regime → amplified breakouts

⚠️ Risk Notes

Katy AI shows neutral → slightly bearish path

Post-earnings drift can invalidate call setup

High IV = potential IV crush

Stick to 2% position size

Strategy: Buy Calls (Earnings Play)

Confidence: 65% (Medium)

Expiry: 2025-11-28

Strike: $6.00

Entry: ~$0.18

Target 1: $0.36

Stop Loss: $0.09

📈 Technical Overview

Price: ~$5.82

Range: $5.25 – $5.87 (tight)

RSI: ~22.4 → Oversold

Volume: 1.1× average → Mild interest

Trend Regime: 95.3% → Strong momentum environment

Support: $5.75 (critical – Katy target)

Resistance: $6.00 / $6.12

IV: ~108% → High earnings volatility

Chart Instructions:

Draw support at $5.75.

Draw resistance line at $6.00–$6.12.

Add RSI indicator (watch for >30 breakout).

Mark option entry zone at $0.18–$0.19.

Plot targets $0.36 and $0.54 (extension).

📰 Sentiment / News Summary

High-impact earnings scheduled

Revenue growth reported at 22,347%

Neutral-to-bullish media tone

Whale activity + call volume shows positioning ahead of earnings

🧪 Flow & Volatility

Put/Call Ratio: 0.37 → Strong call buying

Unusual volume at $6C

Elevated IV ~108% (expect wide moves)

High trend regime → amplified breakouts

⚠️ Risk Notes

Katy AI shows neutral → slightly bearish path

Post-earnings drift can invalidate call setup

High IV = potential IV crush

Stick to 2% position size

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.