📈 11-Day Technical Overview

Over the past 11 trading days, the index has experienced a modest upward movement, indicating a neutral to mildly bullish trend. Key technical indicators suggest a balanced market sentiment:

Relative Strength Index (RSI): Hovering around neutral levels, indicating neither overbought nor oversold conditions.

Moving Average Convergence Divergence (MACD): Currently showing a bullish crossover, suggesting potential upward momentum.

Average Directional Index (ADX): At approximately 22.69, with a Positive Directional Indicator (PDI) at 27.41 and a Negative Directional Indicator (MDI) at 14.54, indicating a mild bullish trend.

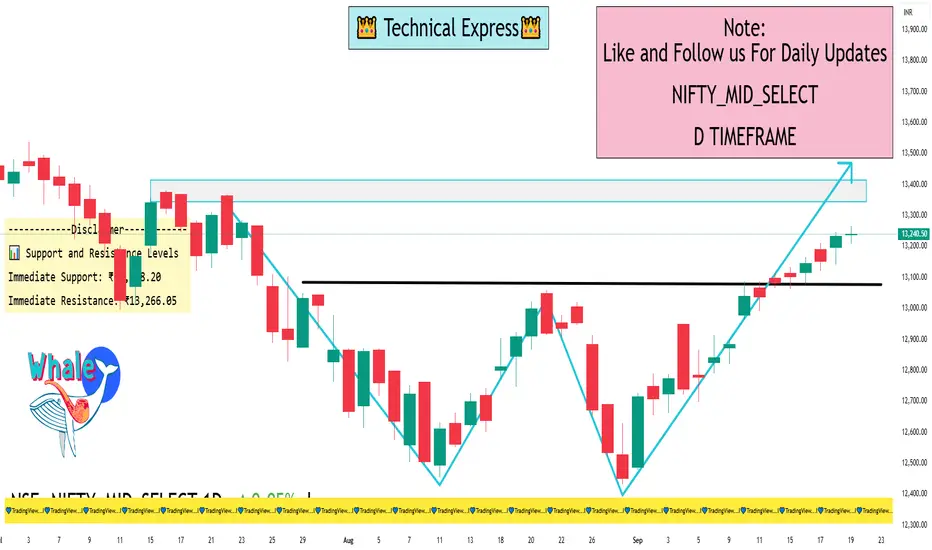

📊 Support and Resistance Levels

Immediate Support: ₹13,208.20

Immediate Resistance: ₹13,266.05

A breakout above the resistance level could signal a continuation of the upward trend, while a dip below support may indicate a potential reversal.

📌 Investment Options

Investors interested in gaining exposure to the Nifty Midcap Select Index can consider the following options:

Exchange-Traded Funds (ETFs): These funds replicate the performance of the index and can be traded on the stock exchange.

Index Funds: Mutual funds that aim to mirror the index's performance.

Futures & Options: Derivative contracts based on the index, suitable for more experienced investors.

Direct Stock Investment: Investing in the constituent stocks of the index in the same proportion as the index.

Over the past 11 trading days, the index has experienced a modest upward movement, indicating a neutral to mildly bullish trend. Key technical indicators suggest a balanced market sentiment:

Relative Strength Index (RSI): Hovering around neutral levels, indicating neither overbought nor oversold conditions.

Moving Average Convergence Divergence (MACD): Currently showing a bullish crossover, suggesting potential upward momentum.

Average Directional Index (ADX): At approximately 22.69, with a Positive Directional Indicator (PDI) at 27.41 and a Negative Directional Indicator (MDI) at 14.54, indicating a mild bullish trend.

📊 Support and Resistance Levels

Immediate Support: ₹13,208.20

Immediate Resistance: ₹13,266.05

A breakout above the resistance level could signal a continuation of the upward trend, while a dip below support may indicate a potential reversal.

📌 Investment Options

Investors interested in gaining exposure to the Nifty Midcap Select Index can consider the following options:

Exchange-Traded Funds (ETFs): These funds replicate the performance of the index and can be traded on the stock exchange.

Index Funds: Mutual funds that aim to mirror the index's performance.

Futures & Options: Derivative contracts based on the index, suitable for more experienced investors.

Direct Stock Investment: Investing in the constituent stocks of the index in the same proportion as the index.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.