📅 NIFTY Trading Plan – 20th May 2025

🕒 Timeframe: 15-Minute | 🎯 Strategy Focus: Price Reaction Zones + Structure-Based Trading + Psychological Triggers

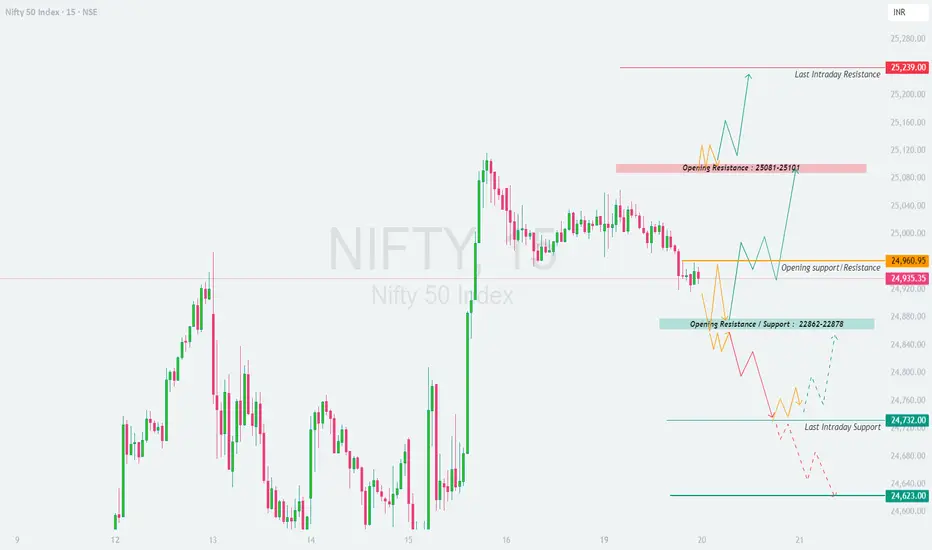

📌 Key Zones to Watch:

🔴 Resistance Zone: 25,081 – 25,101

🟠 Opening Pivot Zone: 24,960 – 24,980

🟦 Initial Support/Resistance: 24,862 – 24,878

🟢 Last Intraday Support: 24,732

🟢 Final Breakdown Support: 24,623

🔺 Last Intraday Resistance: 25,239

📈 Scenario 1: GAP UP Opening (🔺 100+ points) – Opening Above 25,050

If Nifty opens with a strong gap-up directly into or above the resistance zone 25,081 – 25,101, it enters a supply zone from where reversals have occurred in the past.

📌 Educational Note: A gap-up into resistance is a liquidity magnet. Always seek candle confirmation before acting. Momentum traders should only participate if the breakout sustains with strength.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 24,860 – 24,980

This scenario offers the most balanced opportunity to trade both sides, depending on where price moves post-opening.

📌 Educational Note: Flat opens are where the market seeks direction. Don’t trade the first candle — observe whether buyers or sellers dominate before committing capital.

📉 Scenario 3: GAP DOWN Opening (🔻 100+ points) – Opening Below 24,860

A gap-down below the initial support zone 24,862–24,878 sets a bearish tone, but it can trap emotional sellers if not confirmed.

📌 Educational Note: Gap-downs often trigger panic. Smart traders stay calm and react only when price gives clean structure — don’t bottom fish unless a reversal structure appears.

🛡️ Options Trading – Risk Management Tips:

✅ Respect the Premium Decay: Avoid buying far OTM options on Tuesday unless there's strong momentum confirmation.

✅ Set SL as a % of Premium: Use a 30–40% SL of premium for long option positions.

✅ Hedge Naked Options: If selling options, always hedge using defined-risk spreads.

✅ Use Time-Decaying Strategies: Calendar spreads or neutral plays work better in choppy zones.

✅ Position Sizing is Key: Don’t risk more than 1–2% of capital per trade — it protects your mental capital too.

✅ Avoid Holding Naked Positions Overnight: Carry only if hedged or directional clarity is backed by event data.

📊 Summary & Conclusion:

🔼 Above 25,101: Bullish momentum likely → Target 25,180 – 25,239

🔄 Between 24,862 – 24,980: Neutral zone → Wait for breakout or breakdown

🔽 Below 24,862: Bearish tone → Target 24,732 – 24,623 on confirmation

📌 Key Lesson: Let price confirm the move. React, don’t predict. Level-based action always wins over emotions.

📢 Disclaimer:

I am not a SEBI-registered analyst. The above content is shared purely for educational and informational purposes. Please consult your financial advisor or do your own research before taking any trades.

🕒 Timeframe: 15-Minute | 🎯 Strategy Focus: Price Reaction Zones + Structure-Based Trading + Psychological Triggers

📌 Key Zones to Watch:

🔴 Resistance Zone: 25,081 – 25,101

🟠 Opening Pivot Zone: 24,960 – 24,980

🟦 Initial Support/Resistance: 24,862 – 24,878

🟢 Last Intraday Support: 24,732

🟢 Final Breakdown Support: 24,623

🔺 Last Intraday Resistance: 25,239

📈 Scenario 1: GAP UP Opening (🔺 100+ points) – Opening Above 25,050

If Nifty opens with a strong gap-up directly into or above the resistance zone 25,081 – 25,101, it enters a supply zone from where reversals have occurred in the past.

- []Avoid rushing into long trades immediately after a gap-up.

[]Wait for a 15-minute candle close above 25,101 with strong follow-up buying volume to confirm breakout strength.

[]On confirmation, expect targets toward 25,180 → 25,239 (last intraday resistance).

[]However, if price gets rejected from the resistance zone with upper wicks or bearish engulfing candles, then short trades toward 24,980 → 24,960 become favorable. - A failed breakout from this level often leads to a short-trap liquidation move.

📌 Educational Note: A gap-up into resistance is a liquidity magnet. Always seek candle confirmation before acting. Momentum traders should only participate if the breakout sustains with strength.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 24,860 – 24,980

This scenario offers the most balanced opportunity to trade both sides, depending on where price moves post-opening.

- []If price sustains above 24,980 for 15–30 minutes, a breakout attempt toward 25,081 → 25,101 is likely.

[]A clear break and close above 25,101 may trigger long trades aiming for 25,180 → 25,239.

[]On the downside, if price fails to hold above 24,960 and breaks below 24,878, a slide toward 24,732 → 24,623 can unfold.

[]For rangebound movement, you may consider deploying neutral strategies like Iron Fly or ATM straddle with tight SLs.

📌 Educational Note: Flat opens are where the market seeks direction. Don’t trade the first candle — observe whether buyers or sellers dominate before committing capital.

📉 Scenario 3: GAP DOWN Opening (🔻 100+ points) – Opening Below 24,860

A gap-down below the initial support zone 24,862–24,878 sets a bearish tone, but it can trap emotional sellers if not confirmed.

- []If the price opens near 24,840–24,860 and shows early signs of holding, a short-covering move back to 24,960 is possible.

[]However, if price breaches below 24,732 (last intraday support), the index could slide further toward 24,623.

[]Avoid buying blindly just because it's a gap-down — instead, wait for a reversal confirmation (hammer, morning star).

[]Momentum traders can go short below 24,732 with SL above 24,780, targeting 24,650 – 24,623.

📌 Educational Note: Gap-downs often trigger panic. Smart traders stay calm and react only when price gives clean structure — don’t bottom fish unless a reversal structure appears.

🛡️ Options Trading – Risk Management Tips:

✅ Respect the Premium Decay: Avoid buying far OTM options on Tuesday unless there's strong momentum confirmation.

✅ Set SL as a % of Premium: Use a 30–40% SL of premium for long option positions.

✅ Hedge Naked Options: If selling options, always hedge using defined-risk spreads.

✅ Use Time-Decaying Strategies: Calendar spreads or neutral plays work better in choppy zones.

✅ Position Sizing is Key: Don’t risk more than 1–2% of capital per trade — it protects your mental capital too.

✅ Avoid Holding Naked Positions Overnight: Carry only if hedged or directional clarity is backed by event data.

📊 Summary & Conclusion:

🔼 Above 25,101: Bullish momentum likely → Target 25,180 – 25,239

🔄 Between 24,862 – 24,980: Neutral zone → Wait for breakout or breakdown

🔽 Below 24,862: Bearish tone → Target 24,732 – 24,623 on confirmation

📌 Key Lesson: Let price confirm the move. React, don’t predict. Level-based action always wins over emotions.

📢 Disclaimer:

I am not a SEBI-registered analyst. The above content is shared purely for educational and informational purposes. Please consult your financial advisor or do your own research before taking any trades.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.