📌 NIFTY Trading Plan – 04-Apr-2025

📊 Market Overview:

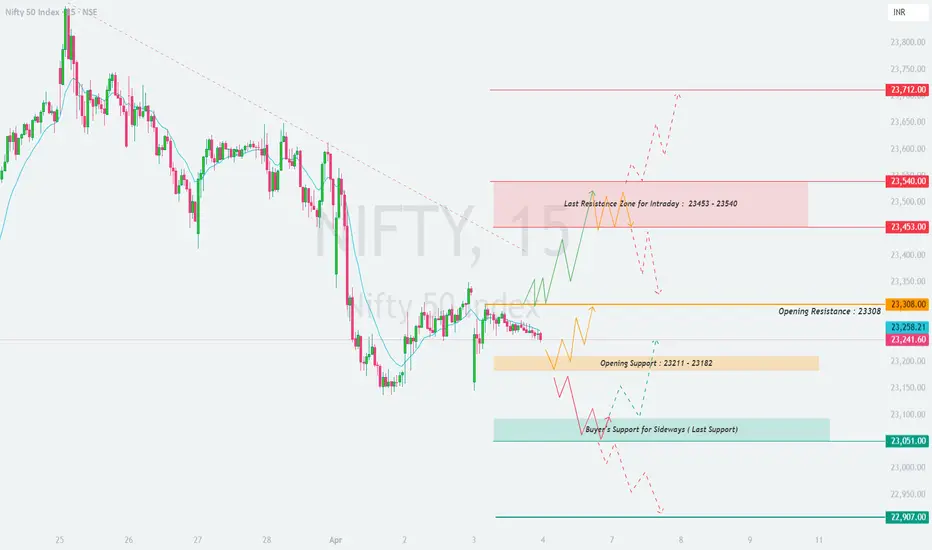

Nifty closed at 23,241.60, showing signs of consolidation around a key support zone. The opening resistance at 23,308 and opening support at 23,211 – 23,182 will be crucial in determining the day's trend.

To navigate this session effectively, we will analyze all potential market opening scenarios and provide an actionable trading strategy.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,308)

A gap-up above 23,308 signals bullish momentum, but the intraday resistance zone of 23,453 – 23,540 will determine if the rally continues.

✅ Plan of Action:

🎯 Pro Tip: If the gap-up struggles to hold 23,308 in the first 15 minutes, profit booking may follow, leading to consolidation or a dip.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,241)

A flat opening suggests indecision, where price action around the opening support (23,211 – 23,182) and resistance (23,308) will set the trend.

✅ Plan of Action:

🎯 Pro Tip: Wait for a strong 15-minute candle close outside the range before initiating a trade to avoid false breakouts.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,182)

A gap-down below 23,182 indicates bearish sentiment, with key support at 23,051 being the last buyer’s zone.

✅ Plan of Action:

🎯 Pro Tip: A gap-down near a strong support zone could trigger a short-covering bounce. Wait for a reversal signal before taking long positions.

⚠️ Risk Management Tips for Options Traders

🛑 Avoid Over-leveraging – Stick to defined risk per trade and avoid emotional trading.

⌛ Theta Decay Awareness – If the market remains sideways, option premiums will erode rapidly.

🔄 Use Spreads for Risk Control – Consider hedged positions like Bull Call or Bear Put spreads instead of naked options.

📊 Trade at Key Levels – Avoid random trades; focus on high-probability setups.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,308 → 23,453 → 23,540 → 23,712

🟧 Opening Support/Resistance Zone: 23,211 – 23,182

🟩 Support: 23,051 → 22,907

🔸 Bullish Bias: Above 23,308, targeting 23,453 – 23,540

🔸 Bearish Bias: Below 23,182, expecting a drop towards 23,051 – 22,907

🔸 Neutral/Choppy: Inside 23,211 – 23,308, wait for a breakout

🎯 Final Advice:

Stick to the trading plan and execute trades only at key levels.

The first 15-30 minutes will define market sentiment—observe price action carefully.

Risk management is crucial—never risk more than you can afford to lose.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

🚀 Stay updated with real-time trade setups!

📊 Market Overview:

Nifty closed at 23,241.60, showing signs of consolidation around a key support zone. The opening resistance at 23,308 and opening support at 23,211 – 23,182 will be crucial in determining the day's trend.

To navigate this session effectively, we will analyze all potential market opening scenarios and provide an actionable trading strategy.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,308)

A gap-up above 23,308 signals bullish momentum, but the intraday resistance zone of 23,453 – 23,540 will determine if the rally continues.

✅ Plan of Action:

- [] If Nifty sustains above 23,308, expect a move towards 23,453 → 23,540. A breakout above 23,540 could trigger further buying towards 23,712.

[] If Nifty faces rejection at 23,453 – 23,540, expect a pullback towards 23,308, where it may either bounce or break down. - Avoid aggressive long positions near 23,540 unless a strong breakout with volume occurs.

🎯 Pro Tip: If the gap-up struggles to hold 23,308 in the first 15 minutes, profit booking may follow, leading to consolidation or a dip.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,241)

A flat opening suggests indecision, where price action around the opening support (23,211 – 23,182) and resistance (23,308) will set the trend.

✅ Plan of Action:

- [] Upside case: If Nifty sustains above 23,308, expect a test of 23,453 – 23,540.

[] Downside case: If Nifty slips below 23,211, it could test 23,182, followed by 23,051 (last buyer’s support zone). - No Trade Zone: Avoid trading inside 23,211 – 23,308 unless a strong breakout or breakdown occurs.

🎯 Pro Tip: Wait for a strong 15-minute candle close outside the range before initiating a trade to avoid false breakouts.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,182)

A gap-down below 23,182 indicates bearish sentiment, with key support at 23,051 being the last buyer’s zone.

✅ Plan of Action:

- [] If Nifty sustains below 23,182, expect a decline towards 23,051. A breakdown below 23,051 could push the index towards 22,907.

[] If Nifty finds support at 23,051 and rebounds, look for a possible recovery towards 23,182 → 23,211. - Avoid panic shorting on a gap-down open; wait for confirmation before entering trades.

🎯 Pro Tip: A gap-down near a strong support zone could trigger a short-covering bounce. Wait for a reversal signal before taking long positions.

⚠️ Risk Management Tips for Options Traders

🛑 Avoid Over-leveraging – Stick to defined risk per trade and avoid emotional trading.

⌛ Theta Decay Awareness – If the market remains sideways, option premiums will erode rapidly.

🔄 Use Spreads for Risk Control – Consider hedged positions like Bull Call or Bear Put spreads instead of naked options.

📊 Trade at Key Levels – Avoid random trades; focus on high-probability setups.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,308 → 23,453 → 23,540 → 23,712

🟧 Opening Support/Resistance Zone: 23,211 – 23,182

🟩 Support: 23,051 → 22,907

🔸 Bullish Bias: Above 23,308, targeting 23,453 – 23,540

🔸 Bearish Bias: Below 23,182, expecting a drop towards 23,051 – 22,907

🔸 Neutral/Choppy: Inside 23,211 – 23,308, wait for a breakout

🎯 Final Advice:

Stick to the trading plan and execute trades only at key levels.

The first 15-30 minutes will define market sentiment—observe price action carefully.

Risk management is crucial—never risk more than you can afford to lose.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

🚀 Stay updated with real-time trade setups!

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.