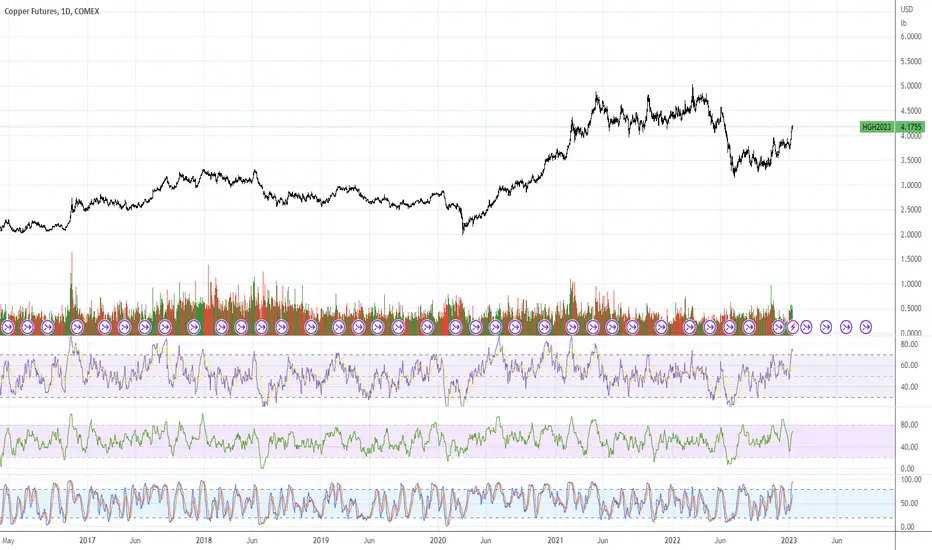

Commodity traders are pumping everything, gold, oil, copper, cattle, hogs, everything I checked.

If they continue to do so, it will force the Fed to go .5% regardless of CPI. A Fed member speaks every day next week, at least one of them will probably say something.

Not as bullish as I was earlier today. Besides, CPI of 6.5% is still above 2% target.

They can't undo QE because they're under water on all of their MBS, so they're slowly letting them expire. I think interest rates will have to remain high until their balance sheet goes down. Take a look at this chart (and now you know why I keep calling Powell stupid):

federalreserve.gov/monetarypolicy/bst_recenttrends.htm

If they continue to do so, it will force the Fed to go .5% regardless of CPI. A Fed member speaks every day next week, at least one of them will probably say something.

Not as bullish as I was earlier today. Besides, CPI of 6.5% is still above 2% target.

They can't undo QE because they're under water on all of their MBS, so they're slowly letting them expire. I think interest rates will have to remain high until their balance sheet goes down. Take a look at this chart (and now you know why I keep calling Powell stupid):

federalreserve.gov/monetarypolicy/bst_recenttrends.htm

Catatan

Funny thing occurred to me....Market celebrates easing inflation by pumping commodity futures, lol. Talk about self defeating.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.