Gold has been hitting new highs recently, primarily driven by expectations of a Federal Reserve rate cut and risk aversion stemming from tariffs and the US economic outlook.

Last Friday, the unexpected NFP data pushed gold prices above the 3,600 mark.

Overall, we still underestimated the upward potential of gold and the impact of multiple data that are bullish for gold.

Because of the surprise of NFP data, the market is now evaluating whether the interest rate cut in September will be 25 basis points or 50 basis points, which will inevitably intensify the bullish sentiment. Therefore, in terms of strategy, we are mainly long, and the pullback support is an opportunity.

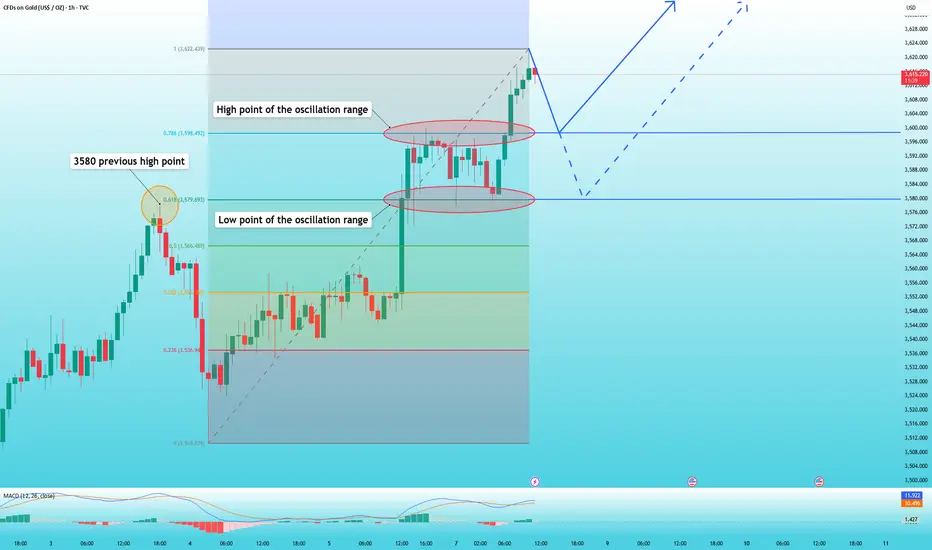

Gold re-entered the 3,600 level at the open today, trading around 3,620. Next, we will focus on two key levels: 3,600 and 3,580.

The Fibonacci retracement of the 3,510-3,622 uptrend shows that 3,600 is at 0.786, while 3,580 is at 0.618, both of which represent previous highs and support levels. Therefore, as long as it falls back to these two positions and stabilizes today, you can enter the market and go long on gold.

However, remember one thing, once it falls below 3580, don't go long.

Last Friday, the unexpected NFP data pushed gold prices above the 3,600 mark.

Overall, we still underestimated the upward potential of gold and the impact of multiple data that are bullish for gold.

Because of the surprise of NFP data, the market is now evaluating whether the interest rate cut in September will be 25 basis points or 50 basis points, which will inevitably intensify the bullish sentiment. Therefore, in terms of strategy, we are mainly long, and the pullback support is an opportunity.

Gold re-entered the 3,600 level at the open today, trading around 3,620. Next, we will focus on two key levels: 3,600 and 3,580.

The Fibonacci retracement of the 3,510-3,622 uptrend shows that 3,600 is at 0.786, while 3,580 is at 0.618, both of which represent previous highs and support levels. Therefore, as long as it falls back to these two positions and stabilizes today, you can enter the market and go long on gold.

However, remember one thing, once it falls below 3580, don't go long.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.