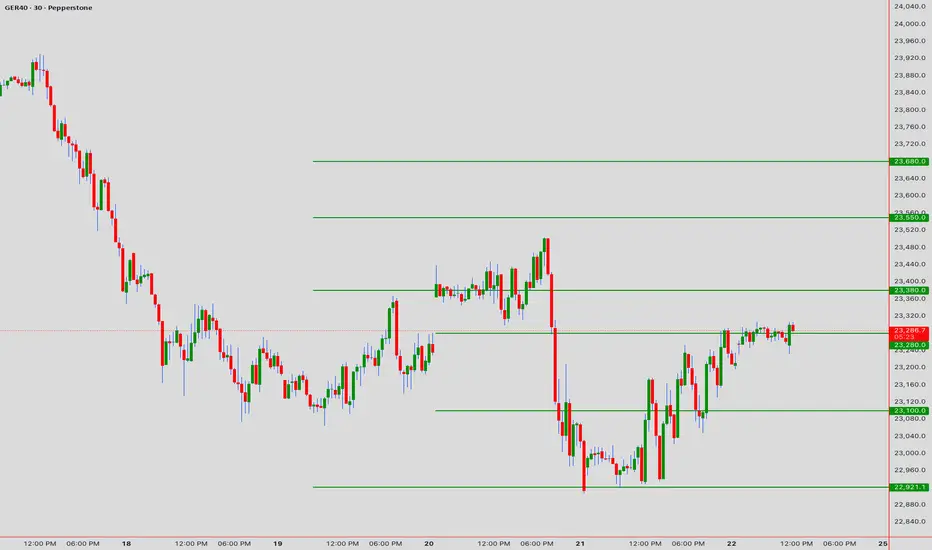

Asset: GER40 (DAX Index)

Current Price: 23,290.00

Date: November 24, 2025

Market Sentiment: The German index is trading at stratospheric levels, testing the 23,300 psychological ceiling. Institutional algorithms are fighting for control between a breakout continuation and a mean-reversion correction.

📊 Technical Indicators & Momentum Analysis

- Trend Structure: The primary trend is STRONGLY BULLISH 🐂 on the Daily timeframe. However, the 1H chart shows a "Rising Wedge" formation, often a precursor to a bearish reversal.

- Relative Strength Index (RSI): Currently at 68.0. We are approaching overbought territory. A bearish divergence is visible between price highs and RSI peaks, signaling waning momentum.

- Bollinger Bands: Price is testing the Upper Band deviation. A failure to close above 23,310 could trigger a snap-back to the 20-period SMA (Mid-Band).

📐 Fibonacci & Harmonic Patterns

- Fibonacci Extension: The current rally has hit the 1.272 extension of the previous correction. The next major resistance aligns with the 1.414 extension at 23,350.

- Harmonic Pattern: A Bearish Butterfly Pattern is nearing completion. The Potential Reversal Zone (PRZ) is calculated between 23,320 and 23,350.

🛡️ Support and Resistance Levels

- Resistance 1: 23,320 (Harmonic PRZ)

- Resistance 2: 23,400 (Psychological Round Number)

- Support 1: 23,220 (Previous High / Support Flip)

- Support 2: 23,150 (0.382 Fib Retracement)

🎯 Strategic Trade Setups

Scenario A: The Reversal (Short)

Valid if price rejects the 23,320 zone with a bearish pin bar.

- Entry: Below 23,280

- Target 1: 23,220

- Target 2: 23,150

- Stop Loss: 23,360

Scenario B: Breakout Continuation (Long)

If price closes above 23,350 on strong volume.

- Entry: Retest of 23,350

- Target: 23,450

- Stop Loss: 23,300

⚠️ Summary: Caution is advised. The confluence of the Bearish Butterfly pattern and RSI divergence suggests a high probability of a pullback from the 23,320 region. We favor Scenario A for the intraday session. 📉🇩🇪

I am nothing @shunya.trade

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am nothing @shunya.trade

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.