Technical Overview

Weekly:

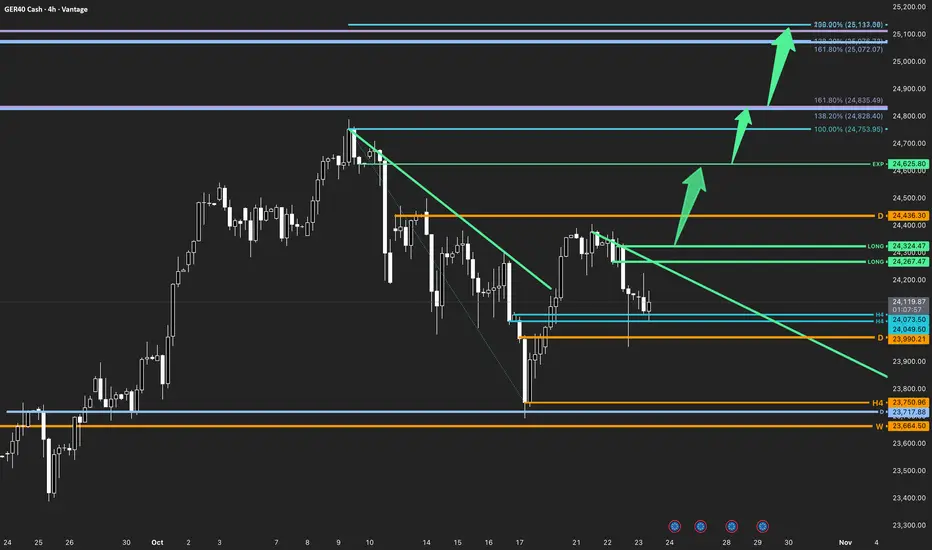

The broader trend remains bullish, maintaining higher-high and higher-low structure. Price action continues to trade above the weekly pivot zone, confirming medium-term trend alignment to the upside.

Daily:

A valid countertrend structure is present. The last daily breakdown has been broken by a clean impulsive wave that also pierced the countertrend line, suggesting early transition from correction toward potential expansion.

Bias remains constructive as long as price holds above the lower daily pivot at 23,990.

H4:

The structure shows price consolidating beneath the broken countertrend line, forming a short-term base around the 24,050–24,100 zone. A sustained close above 24,324 would confirm trigger alignment and open path toward 24,625 (EXP) and 24,850–25,100 Fibonacci extensions.

Trade Structure & Levels

Bias: Long above 23,990

Trigger Zone: 24,324–24,625

Invalidation: Daily close below 23,990 or H4 close below 23,750

Path → 24,625 → 24,850 → 25,100

Phase: Accumulation (pre-expansion)

Risk & Event Context

The GER40 remains in a technical accumulation phase within a bullish weekly structure. Volatility is moderate, and continuation depends on reclaiming upper trigger levels.

Conclusion

As long as the structure holds above the active daily and H4 pivots, the setup favors an eventual continuation toward expansion.

Weekly:

The broader trend remains bullish, maintaining higher-high and higher-low structure. Price action continues to trade above the weekly pivot zone, confirming medium-term trend alignment to the upside.

Daily:

A valid countertrend structure is present. The last daily breakdown has been broken by a clean impulsive wave that also pierced the countertrend line, suggesting early transition from correction toward potential expansion.

Bias remains constructive as long as price holds above the lower daily pivot at 23,990.

H4:

The structure shows price consolidating beneath the broken countertrend line, forming a short-term base around the 24,050–24,100 zone. A sustained close above 24,324 would confirm trigger alignment and open path toward 24,625 (EXP) and 24,850–25,100 Fibonacci extensions.

Trade Structure & Levels

Bias: Long above 23,990

Trigger Zone: 24,324–24,625

Invalidation: Daily close below 23,990 or H4 close below 23,750

Path → 24,625 → 24,850 → 25,100

Phase: Accumulation (pre-expansion)

Risk & Event Context

The GER40 remains in a technical accumulation phase within a bullish weekly structure. Volatility is moderate, and continuation depends on reclaiming upper trigger levels.

Conclusion

As long as the structure holds above the active daily and H4 pivots, the setup favors an eventual continuation toward expansion.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.