Quick Recap: Last week Expected Ranges levels in action

What is Expected Range Volatility (ER)?

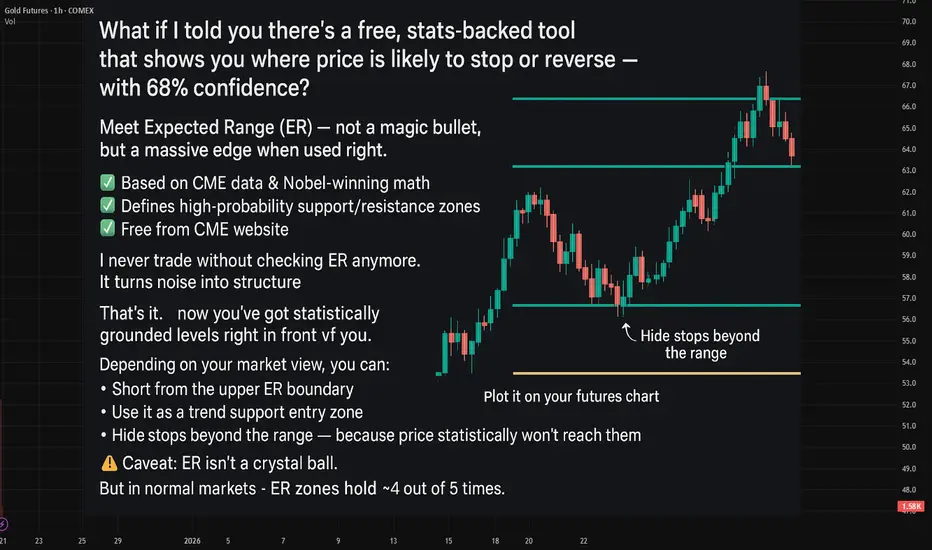

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

What is Expected Range Volatility (ER)?

The Expected Range (ER) is a framework that helps traders understand how much an asset is likely to move within a specific timeframe. Based on CME market data and Nobel Prize-winning calculations, price movements within the expected volatility corridor have a 68%-95% probability of staying within those boundaries.

Crude Oil - 6 reactions to levels🔥

EUR - 4 reactions to levels

BTC - 3 reactions

GOLD - 1 reaction to levels

It's really an amazing tool to enhance your market entry💲

!!!- It doesn't guarantee trades every day.

!! it's better to combine it when working with the trend and when there's a clear sideways movement.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.