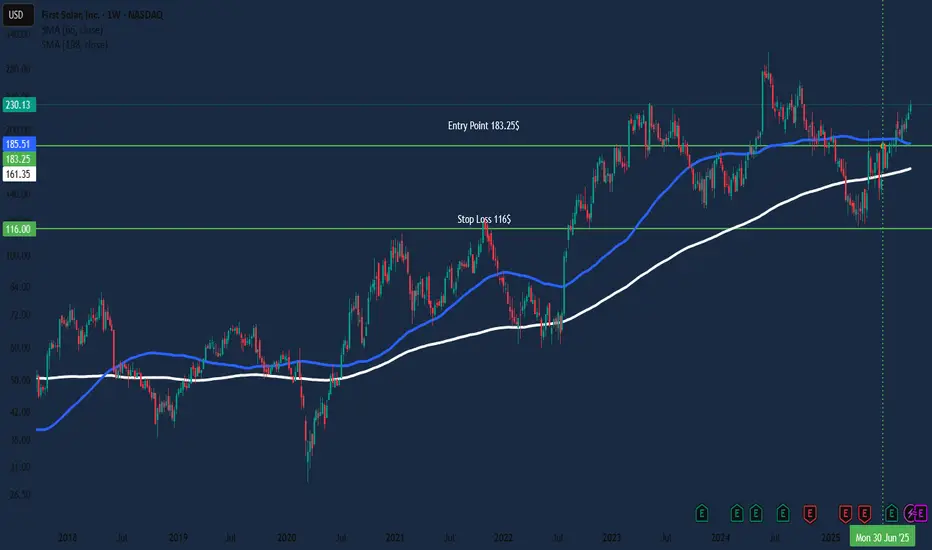

Entered a position in First Solar (FSLR) at $183.25. This trade setup presents strong fundamentals, including impressive profitability and financial health, though there are a few risks to monitor.

🔑 Key Strengths:

✅ Strong profitability turnaround (Net Income up to $1.26B TTM)

✅ Debt-free with a solid Debt-to-Equity of 0.12

✅ Excellent efficiency (Gross Margin of 45.6%)

✅ Exposure to expanding clean energy markets both in the U.S. and globally

⚠️ Risks to Keep an Eye On:

❗️ Negative Free Cash Flow (-$942M TTM) due to heavy CapEx

❗️ Tightening liquidity (Quick Ratio of 1.41)

Given the favorable technical setup and strong fundamentals, this is a solid mid-term swing trade, but the cash flow and liquidity concerns will need close monitoring.

Would love to hear your thoughts—do you think FSLR is still undervalued, or is it priced for perfection?

🔑 Key Strengths:

✅ Strong profitability turnaround (Net Income up to $1.26B TTM)

✅ Debt-free with a solid Debt-to-Equity of 0.12

✅ Excellent efficiency (Gross Margin of 45.6%)

✅ Exposure to expanding clean energy markets both in the U.S. and globally

⚠️ Risks to Keep an Eye On:

❗️ Negative Free Cash Flow (-$942M TTM) due to heavy CapEx

❗️ Tightening liquidity (Quick Ratio of 1.41)

Given the favorable technical setup and strong fundamentals, this is a solid mid-term swing trade, but the cash flow and liquidity concerns will need close monitoring.

Would love to hear your thoughts—do you think FSLR is still undervalued, or is it priced for perfection?

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.