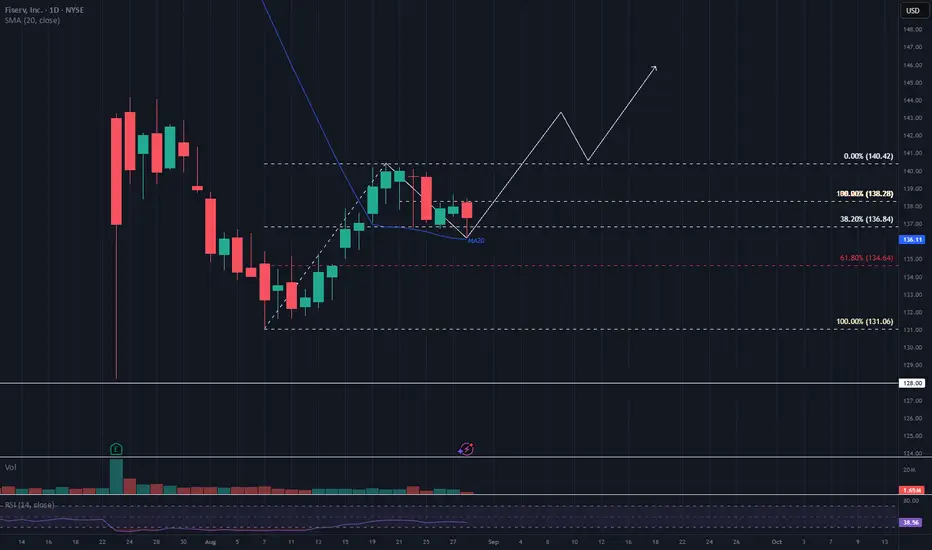

FI is currently moving slowly after a sharp decline triggered by ER. Technically, the stock appears to be well-supported by the MA20 and the 38.2% Fibonacci retracement level.

Despite the sluggish pace, the chart suggests a potential uptrend. In the first phase, I anticipate a move toward the $140 level, with a possible breakout. Following that, the price may seek support around ~$140 before continuing upward toward $145 in the second phase.

This is a technical observation and not a recommendation to buy or sell.

Despite the sluggish pace, the chart suggests a potential uptrend. In the first phase, I anticipate a move toward the $140 level, with a possible breakout. Following that, the price may seek support around ~$140 before continuing upward toward $145 in the second phase.

This is a technical observation and not a recommendation to buy or sell.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.