Cut the Noise: The Fed Is on Track for a September Rate Cut

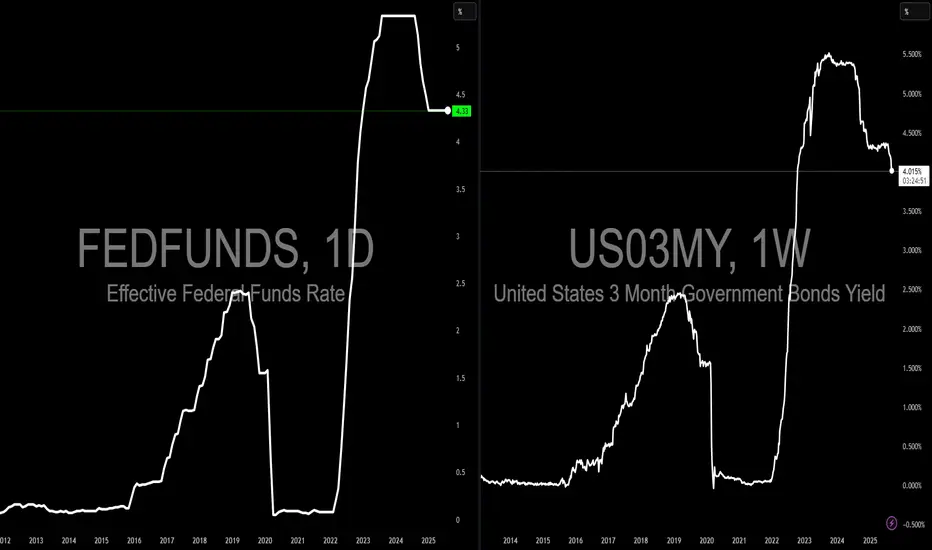

I’m seeing a lot of wild takes floating around right now, things like a surprise rate hike or claims that QE is driving us into a crash. That’s pure noise, and complete nonsense. The facts are straightforward: QT is still ongoing, the Fed’s balance sheet has been unwound (anyone can fact-check that), and a rate cut on 9/17 is almost certain, most likely 25 bps, which would mark the start of a new easing cycle. The dot plots already show the range, and if you look at the chart comparing fed funds to the 3-month yield, it’s clear the Fed is actually late to cutting. JP had also hinted that the easing would have already begun had the Tariffs (taxes) not kicked off. I will not torture you readers with more tariff information but let's also be clear, tariffs are simply a tax. They are transitory by nature, now uncertain, and already priced in. “Liberation day” is behind us, and those expecting some massive equity washout because of tariffs are months late. Even Powell himself hinted that easing would have begun earlier if not for the tariff overhang. I’ll spare you a deep dive into tariff mechanics, but the bottom line is they are temporary tax distortions, not permanent anchors on growth. Likewise they are not permanent catalysts of inflation. We likewise know tariffs were impacting select products like apparel, textiles, automobile parts and some technology significantly more than other sectors & products.

On top of that, we’ve had bearish ISM manufacturing data, the transportation sector showing the weakest $/mile in memory (related to the cost variables), and consecutive soft jobs numbers. Those arguing that inflation is resurging are ignoring the Fed’s dual mandate: employment and inflation. Right now, employment stress is outweighing inflation risks, and Main Street is hurting. The market, being forward-looking, knows this.

In a K-shaped recession, debt-dependent sectors are under real strain, while high-margin, scalable sectors like technology continue to grow and deliver true earnings. That’s why the bull market in equities, crypto, and gold is still intact and mainstreet remains suffering.

We will get out of the recession and back into growth mode, and other sectors will see earnings improvement. All the while, crypto is an emerging market and will most likely rise a great deal, and Gold will still continue to pump. Briefly I will mention that I recently saw a bloomberg chart exhibiting central banks now holding more gold than US Treasuries - and we must realize this is yet another sign that most likely Treasury yield will be dropping. This is coupled with a weak dollar which was no surprise as the dollar was so weak in the initial trump administration as well. The logic someone could argue is that weaker dollars leads to more exports, less imports.

On top of that, we’ve had bearish ISM manufacturing data, the transportation sector showing the weakest $/mile in memory (related to the cost variables), and consecutive soft jobs numbers. Those arguing that inflation is resurging are ignoring the Fed’s dual mandate: employment and inflation. Right now, employment stress is outweighing inflation risks, and Main Street is hurting. The market, being forward-looking, knows this.

In a K-shaped recession, debt-dependent sectors are under real strain, while high-margin, scalable sectors like technology continue to grow and deliver true earnings. That’s why the bull market in equities, crypto, and gold is still intact and mainstreet remains suffering.

We will get out of the recession and back into growth mode, and other sectors will see earnings improvement. All the while, crypto is an emerging market and will most likely rise a great deal, and Gold will still continue to pump. Briefly I will mention that I recently saw a bloomberg chart exhibiting central banks now holding more gold than US Treasuries - and we must realize this is yet another sign that most likely Treasury yield will be dropping. This is coupled with a weak dollar which was no surprise as the dollar was so weak in the initial trump administration as well. The logic someone could argue is that weaker dollars leads to more exports, less imports.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.