🔹 Current Overview

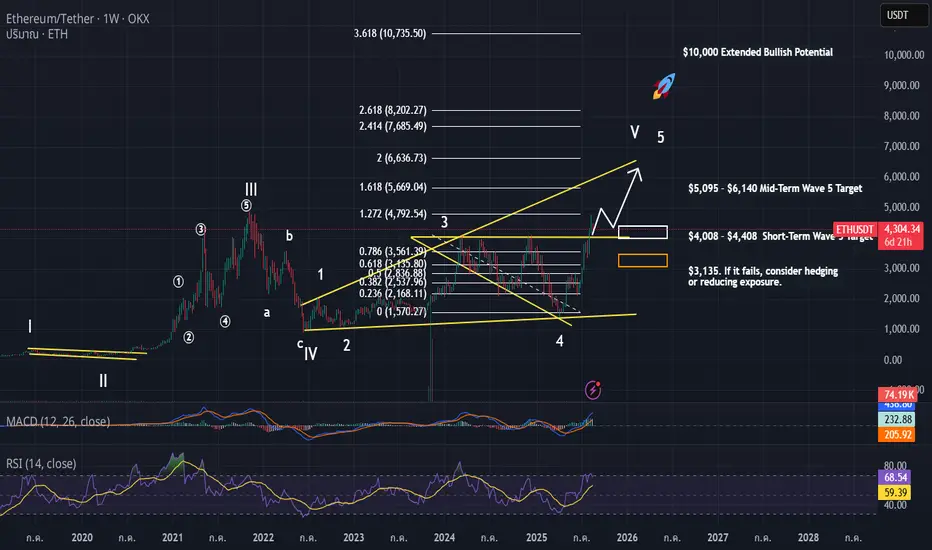

Ethereum (ETH) is approaching a critical decision point in the Elliott Wave cycle. Based on the long-term structure, we are now at a crossroads: either ETH confirms a Wave 5 bullish continuation, or we see an extended corrective Wave IV before resuming the uptrend.

📈 Bullish Scenario – Wave 5 Extension

Key Breakout Level: $4,400

If ETH can break and sustain above $4,400 with strong volume, Wave 5 will likely extend higher.

Upside Targets:

$5,095 – $5,350 (Fibo 1.272)

$5,850 – $6,140 (Fibo 1.618)

$9,800 – $10,000+ (Extended Wave 5 under Macro Bull Run)

Confirmation Signals:

RSI > 70 (Weekly)

MACD Golden Cross on higher timeframes

📉 Bearish Scenario – Extended Correction (Wave IV not complete)

Key Supports:

$3,580 (Fibo 0.5 retracement)

$3,135 (Fibo 0.618 retracement)

If ETH fails to hold $3,580, it could indicate that Wave IV correction is still in play.

A break below $3,135 would confirm a deeper correction, potentially targeting $2,650.

Warning Signals:

Decreasing volume on rallies

RSI unable to create higher highs

🎯 Trading Plan

If Breakout: Long/hold positions with targets at $5k+

If Breakdown: Wait for support test at $3,135. If it fails, consider hedging or reducing exposure.

Risk Management: Always use stop loss below $3,100 and limit exposure to 3–5% per position.

⚠️ Risk Disclaimer

This analysis is for educational purposes only and should not be taken as financial advice. Cryptocurrency markets are highly volatile – always do your own research and apply strict risk management before trading.

Ethereum (ETH) is approaching a critical decision point in the Elliott Wave cycle. Based on the long-term structure, we are now at a crossroads: either ETH confirms a Wave 5 bullish continuation, or we see an extended corrective Wave IV before resuming the uptrend.

📈 Bullish Scenario – Wave 5 Extension

Key Breakout Level: $4,400

If ETH can break and sustain above $4,400 with strong volume, Wave 5 will likely extend higher.

Upside Targets:

$5,095 – $5,350 (Fibo 1.272)

$5,850 – $6,140 (Fibo 1.618)

$9,800 – $10,000+ (Extended Wave 5 under Macro Bull Run)

Confirmation Signals:

RSI > 70 (Weekly)

MACD Golden Cross on higher timeframes

📉 Bearish Scenario – Extended Correction (Wave IV not complete)

Key Supports:

$3,580 (Fibo 0.5 retracement)

$3,135 (Fibo 0.618 retracement)

If ETH fails to hold $3,580, it could indicate that Wave IV correction is still in play.

A break below $3,135 would confirm a deeper correction, potentially targeting $2,650.

Warning Signals:

Decreasing volume on rallies

RSI unable to create higher highs

🎯 Trading Plan

If Breakout: Long/hold positions with targets at $5k+

If Breakdown: Wait for support test at $3,135. If it fails, consider hedging or reducing exposure.

Risk Management: Always use stop loss below $3,100 and limit exposure to 3–5% per position.

⚠️ Risk Disclaimer

This analysis is for educational purposes only and should not be taken as financial advice. Cryptocurrency markets are highly volatile – always do your own research and apply strict risk management before trading.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.