Same map as last night.

Bias & structure

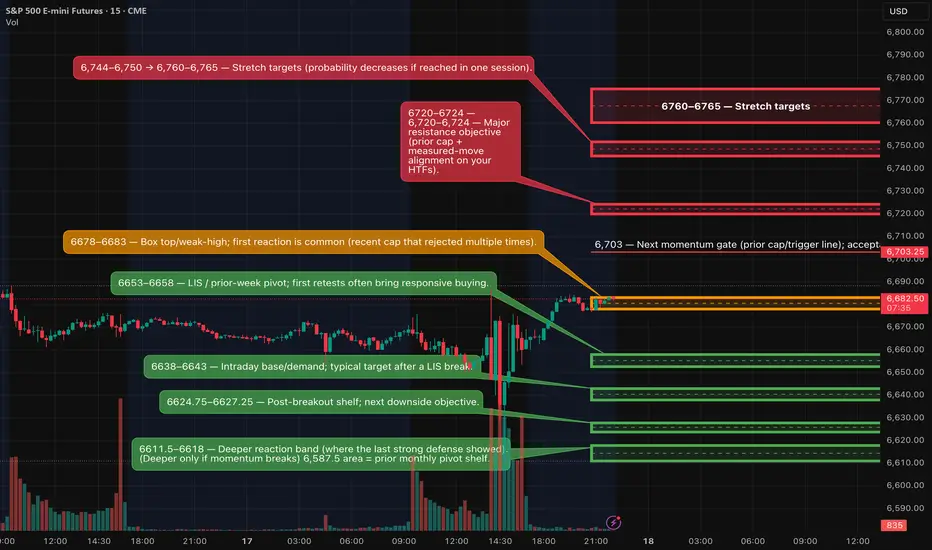

Price is pressing the box top 6,678–6,683 (1h AS.H 6,683.25) with a dense extension liquidity pocket above (D: 1.272 ≈ 6,763, 1.618 ≈ 6,856, 2.0 ≈ 6,959). We trade edge-only: fade a rejection at the top, or buy a sweep-and-reclaim at the control level.

Kill-zones (ET): London 02:00–05:00 (½–¾ size); NY AM 09:30–11:00; NY PM 13:30–16:00.

London (2 setups)

SHORT — Rejection Fade @ 6,678–6,683

15m tag → 15m close back ≤ 6,675 → 5m LH/re-close 6,672–6,674 → 1m LH entry 6,679–6,682.

Hard SL: above 15m rejection high +0.25–0.50.

TPs: 6,666–6,668 → 6,653–6,658 → 6,638–6,643.

Cancel if two 15m body-closes ≥ 6,685. Gate: TP1 ≥ 2.0R.

LONG — Sweep & Reclaim @ 6,653–6,658 (bias pivot)

Wick below LIS → 15m close back ≥ 6,658 → 5m re-close up 6,664–6,666 + HL → 1m HL entry 6,659–6,662.

Hard SL: below sweep low −0.25–0.50.

TPs: 6,678–6,683 → 6,703 → 6,720–6,724 (runner eyes 6,744–6,750).

U.S. (NY) (2 setups)

LONG — Acceptance Continuation > 6,683

Two 5m closes ≥ 6,685 (or one decisive 15m) → PB hold 6,679–6,683 flips to support → enter on 1m HL.

SL: under acceptance pivot −0.50–1.00.

TPs: 6,703 → 6,720–6,724 → 6,744–6,750 (→ 6,760–6,765).

Fail back below 6,679 on 5m = stand down.

SHORT — Breakdown & Failed Reclaim < 6,653

15m body close < 6,653 → retest fails (6,653–6,658 caps) → sell 6,651–6,654 on the fail.

SL: above fail-wick +0.50–1.00.

TPs: 6,638–6,643 → 6,624.75–6,627.25 → 6,611.5–6,618.

Back above 6,658 on 5m = invalidate.

Management (all plays)

First-touch priority; TP1 ≥ 2.0R gate using the 15m-anchored hard SL; no partials before TP1; at TP1 close 70% and set runner to BE; time-stop 45–60m if neither TP1 nor SL hits; max 2 attempts per level per session.

Fundamentals to respect (London → U.S. a.m.)

Bank of England MPC decision & minutes — Thu 12:00 BST (07:00 ET). High-impact for indices/GBP; often injects vol into London PM/NY open.

UK ONS releases — Thu 09:30 BST (04:30 ET) (e.g., housing affordability & Business Insights this week). Moderate.

U.S. Weekly Jobless Claims — Thu 08:30 ET (every Thursday; schedule page).

• Philly Fed Manufacturing Survey — Thu 08:30 ET.

• EIA Natural Gas Storage — Thu 10:30 ET.

Bias & structure

Price is pressing the box top 6,678–6,683 (1h AS.H 6,683.25) with a dense extension liquidity pocket above (D: 1.272 ≈ 6,763, 1.618 ≈ 6,856, 2.0 ≈ 6,959). We trade edge-only: fade a rejection at the top, or buy a sweep-and-reclaim at the control level.

Kill-zones (ET): London 02:00–05:00 (½–¾ size); NY AM 09:30–11:00; NY PM 13:30–16:00.

London (2 setups)

SHORT — Rejection Fade @ 6,678–6,683

15m tag → 15m close back ≤ 6,675 → 5m LH/re-close 6,672–6,674 → 1m LH entry 6,679–6,682.

Hard SL: above 15m rejection high +0.25–0.50.

TPs: 6,666–6,668 → 6,653–6,658 → 6,638–6,643.

Cancel if two 15m body-closes ≥ 6,685. Gate: TP1 ≥ 2.0R.

LONG — Sweep & Reclaim @ 6,653–6,658 (bias pivot)

Wick below LIS → 15m close back ≥ 6,658 → 5m re-close up 6,664–6,666 + HL → 1m HL entry 6,659–6,662.

Hard SL: below sweep low −0.25–0.50.

TPs: 6,678–6,683 → 6,703 → 6,720–6,724 (runner eyes 6,744–6,750).

U.S. (NY) (2 setups)

LONG — Acceptance Continuation > 6,683

Two 5m closes ≥ 6,685 (or one decisive 15m) → PB hold 6,679–6,683 flips to support → enter on 1m HL.

SL: under acceptance pivot −0.50–1.00.

TPs: 6,703 → 6,720–6,724 → 6,744–6,750 (→ 6,760–6,765).

Fail back below 6,679 on 5m = stand down.

SHORT — Breakdown & Failed Reclaim < 6,653

15m body close < 6,653 → retest fails (6,653–6,658 caps) → sell 6,651–6,654 on the fail.

SL: above fail-wick +0.50–1.00.

TPs: 6,638–6,643 → 6,624.75–6,627.25 → 6,611.5–6,618.

Back above 6,658 on 5m = invalidate.

Management (all plays)

First-touch priority; TP1 ≥ 2.0R gate using the 15m-anchored hard SL; no partials before TP1; at TP1 close 70% and set runner to BE; time-stop 45–60m if neither TP1 nor SL hits; max 2 attempts per level per session.

Fundamentals to respect (London → U.S. a.m.)

Bank of England MPC decision & minutes — Thu 12:00 BST (07:00 ET). High-impact for indices/GBP; often injects vol into London PM/NY open.

UK ONS releases — Thu 09:30 BST (04:30 ET) (e.g., housing affordability & Business Insights this week). Moderate.

U.S. Weekly Jobless Claims — Thu 08:30 ET (every Thursday; schedule page).

• Philly Fed Manufacturing Survey — Thu 08:30 ET.

• EIA Natural Gas Storage — Thu 10:30 ET.

If you want to contact me Email: info@algoindex.com or algoindex.com

Publikasi terkait

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you want to contact me Email: info@algoindex.com or algoindex.com

Publikasi terkait

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.