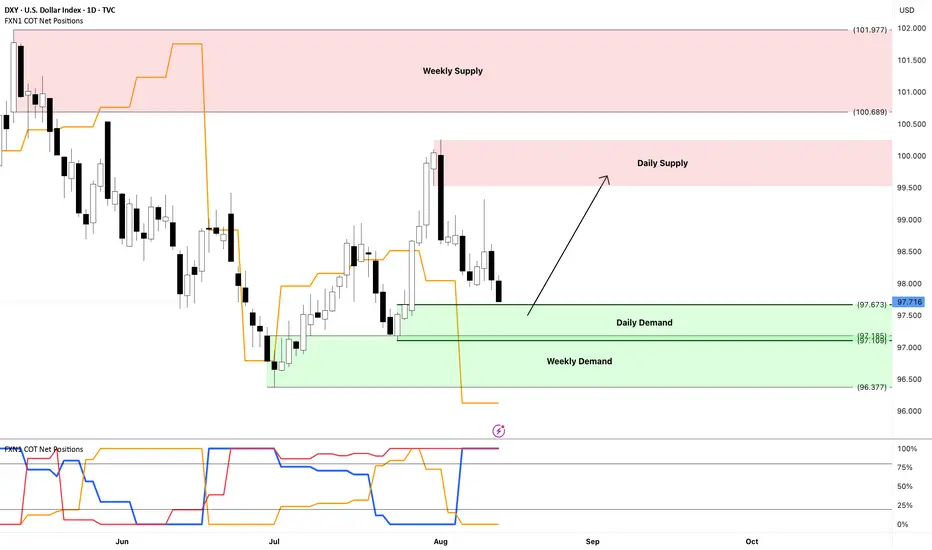

The US Consumer Price Index (CPI) report released yesterday acted as a headwind for the dollar. Although core inflation rose to 3.1% year-over-year and 0.33% month-over-month—figures that are not ideal—they are not severe enough to overshadow the recent weakening in the jobs market. On the USD chart, the price is approaching a significant daily demand zone, which is anchored by a weekly demand area. This confluence could potentially serve as a turning point, offering a possible opportunity for the USD to rebound.

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

✅ Please share your thoughts about DXY in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Publikasi terkait

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Publikasi terkait

Pernyataan Penyangkalan

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.