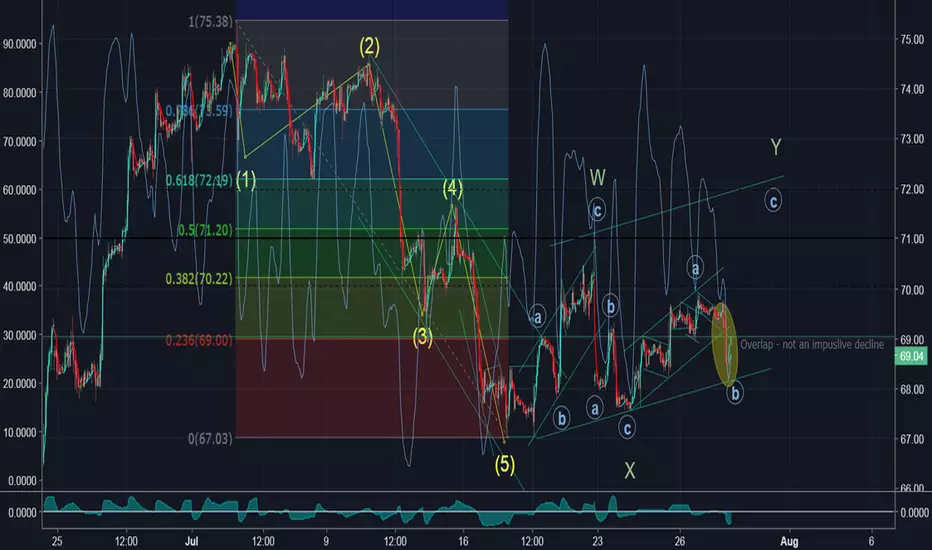

WTI -One leg up into more sophisticated corrective rise

There is a possible one more leg up in WTI. The last decline (elipce mark) is not an impulsive due to the overlap within it.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

In case that is true to the market there is some potential in wave Y. RSX 1H is to the upside.

Trading ditutup: target tercapai

Possible level for the end of the current corrective rise. RSX 1H is still forming the turn to the downside but not yet. This is also can be only the end of wave a in Y. That should be enough to get stop order into break even zone.

Trading ditutup secara manual

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.