Bitcoin has repeatedly corrected ~mid-20% during the last 12–24 months. Using this empirical drawdown profile, a base-case correction of ~25% from a recent $126,000 high implies a **probable correction low near $94,500–$95,000.

This is a high probability forecast based on real math and stats, not science

fiction. No expanding triangles, Elliott Wave counts, Wolfe and Dragon patterns.

Bitcoin does not trade by the textbook. This is real world TA by a pro trader.

Tactical view: Expect a final flush toward ~$95k, then a reversal/bounce if market structure and liquidity conditions confirm.

Confidence: VERY HIGH —pattern consistency is notable, but crypto remains headline- and liquidity-sensitive. Use disciplined risk controls. 🧠

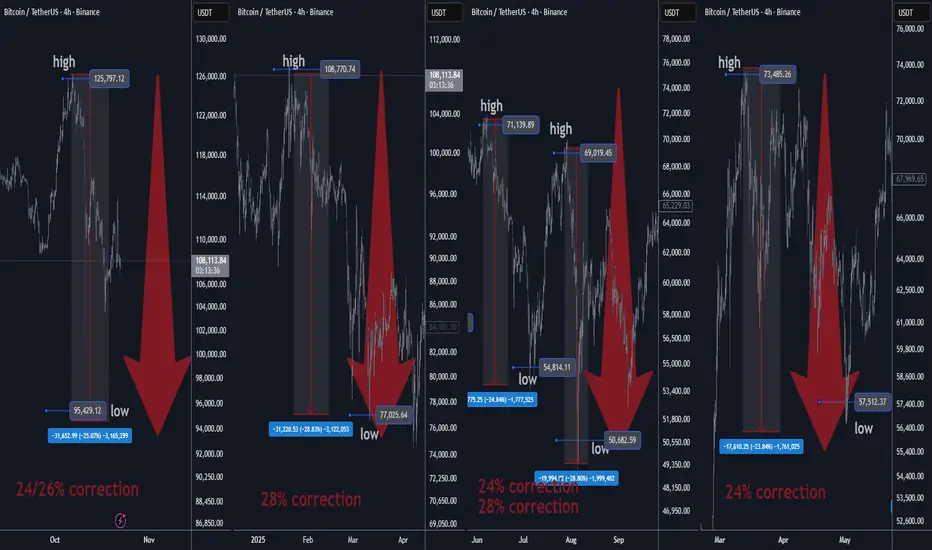

2) Recent Corrections (Past 12–24 Months)

# High → Low % Drawdown

1 $72,000 → $54,000 25%

2 $108,000 → $76,000 28%

3 $70,000 → $50,000 28%

4 $74,000 → $56,000 24%

Empirical mean drawdown:

(25+28+28+24)÷4 = 26.25%.

We’ll use 25% as the base-case assumption (conservative vs. the 26.25% mean). ✅

Projection for the Current Correction

Reference high: $126,000

Base-case (25%) low:

$126,000 × (1 − 0.25) = $94,500

Empirical-mean (26.25%) low:

$126,000 × (1 − 0.2625) = $92,925

Projected buy-zone: $92.9k – $95k, centered near $95k. 🎯

This is a high probability forecast based on real math and stats, not science

fiction. No expanding triangles, Elliott Wave counts, Wolfe and Dragon patterns.

Bitcoin does not trade by the textbook. This is real world TA by a pro trader.

Tactical view: Expect a final flush toward ~$95k, then a reversal/bounce if market structure and liquidity conditions confirm.

Confidence: VERY HIGH —pattern consistency is notable, but crypto remains headline- and liquidity-sensitive. Use disciplined risk controls. 🧠

2) Recent Corrections (Past 12–24 Months)

# High → Low % Drawdown

1 $72,000 → $54,000 25%

2 $108,000 → $76,000 28%

3 $70,000 → $50,000 28%

4 $74,000 → $56,000 24%

Empirical mean drawdown:

(25+28+28+24)÷4 = 26.25%.

We’ll use 25% as the base-case assumption (conservative vs. the 26.25% mean). ✅

Projection for the Current Correction

Reference high: $126,000

Base-case (25%) low:

$126,000 × (1 − 0.25) = $94,500

Empirical-mean (26.25%) low:

$126,000 × (1 − 0.2625) = $92,925

Projected buy-zone: $92.9k – $95k, centered near $95k. 🎯

Catatan

let me know your thoughts on the above in the comments section 🔥🏧🚀Catatan

🎁Please hit the like button and🎁Leave a comment to support our team!

Catatan

Massive Bitcoin Whale Initiates Whopping $122,000,000 BTC Shortdailyhodl.com/2025/10/21/massive-bitcoin-whale-initiates-whopping-122000000-btc-short/

Catatan

No BTC won't reverse at 100k, because someone told you so on X or TikTokCatatan

pro traders don't use MACD RSI and other useless garbage crossovers EW etcforget about trading bitcoin by the book not going to work you will blow up your account

Catatan

my previous analysis belowTrade aktif

break below 100k incomingCatatan

it's not an alt coin season now.it's not bitcoin season now.

it's bear season now.

figure it out already.

Trading ditutup: target tercapai

where the moon boys at?Catatan

BOOM. BTC BROKE BELOW 100 000 USD. TRADING NEAR 99 000 USD NOW.Catatan

100 000 USD WAS NEVER A VALID S/R ZONE. STOP WATCHING TA ON TIKTOK AND TWITTER.Catatan

target revised to 90 000 USDCatatan

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS🪙 Trend: Uptrend intact long-term, but near-term tape turning distributive.

🏔️ Key Sell Zone: $4,220–$4,320 — prime area to short rips into supply.

🐻 Bear Liquidity: $4,350 (fresh liquidity) → expect rejection / reversal.

📉 Stretch Stop-Run: $4,380 — only hit on squeeze; short bias still valid below here.

📊 Downside Targets: $4,060 → $4,000 → $3,960.

🛡️ Major Support: $3,930–$3,940 bullish block (HTF buyers defend).

⛔ Bear Expansion: Break below $3,930 = opens $3,880–$3,850.

💱 Macro: Lower real yields + softer USD = supportive but not enough to chase highs.

🏦 Flows: Strong central-bank buying keeps floor firm but upside crowded.

🎯 Strategy: Fade all strength into $4,220–$4,350; take profits down into $4,060–$3,960.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.