Beginner!

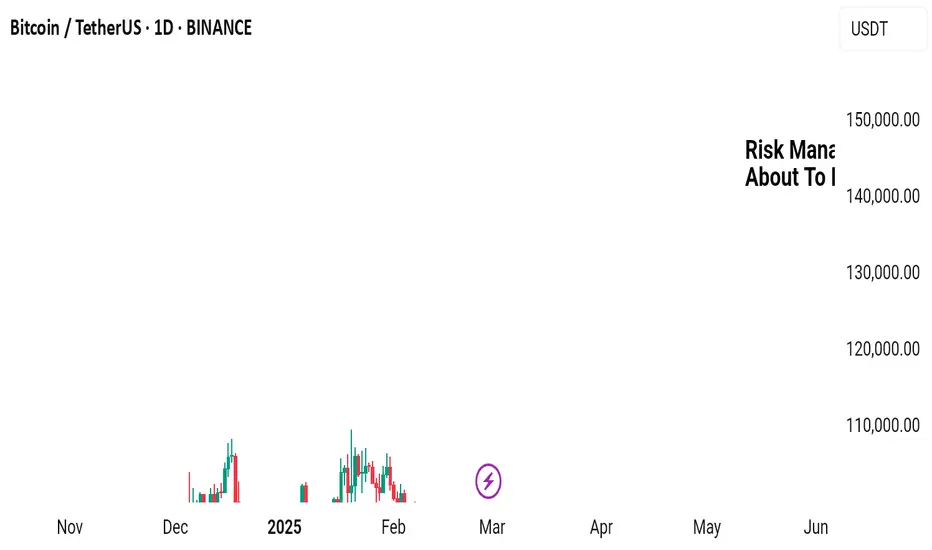

Chasing profits is not the only purpose of smart trading. It is also about managing risk correctly. Every trade comes with uncertainty, and without a solid strategy, even the best opportunities can turn into costly mistakes. That’s where the 3-5-7 Rule comes in.

Think of it as a built-in safety net for your trades, a simple yet powerful guideline that helps you balance risk and reward. By setting clear limits on your exposure per trade, per market, and across your portfolio, the 3-5-7 Rule keeps you in control, protecting your investments from unexpected losses.

In this guide, we’ll break it all down: how the rule works, why it’s effective, and how you can apply it to your own trading strategy. Plus, we’ll walk through real examples to make it practical and easy to follow. By the end, you’ll be trading with more confidence, better discipline, and a clear plan to keep risk in check.

What is the 3 5 7 Rule?

The 3 5 7 rule works on a simple principle: never risk more than 3% of your trading capital on any single trade; limit your overall exposure to 5% of your capital on all open trades combined; and ensure your winning trades are at least 7% more profitable than your losing trades. It’s simple in theory, but success depends on discipline and consistency.

Chasing profits is not the only purpose of smart trading. It is also about managing risk correctly. Every trade comes with uncertainty, and without a solid strategy, even the best opportunities can turn into costly mistakes. That’s where the 3-5-7 Rule comes in.

Think of it as a built-in safety net for your trades, a simple yet powerful guideline that helps you balance risk and reward. By setting clear limits on your exposure per trade, per market, and across your portfolio, the 3-5-7 Rule keeps you in control, protecting your investments from unexpected losses.

In this guide, we’ll break it all down: how the rule works, why it’s effective, and how you can apply it to your own trading strategy. Plus, we’ll walk through real examples to make it practical and easy to follow. By the end, you’ll be trading with more confidence, better discipline, and a clear plan to keep risk in check.

What is the 3 5 7 Rule?

The 3 5 7 rule works on a simple principle: never risk more than 3% of your trading capital on any single trade; limit your overall exposure to 5% of your capital on all open trades combined; and ensure your winning trades are at least 7% more profitable than your losing trades. It’s simple in theory, but success depends on discipline and consistency.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.