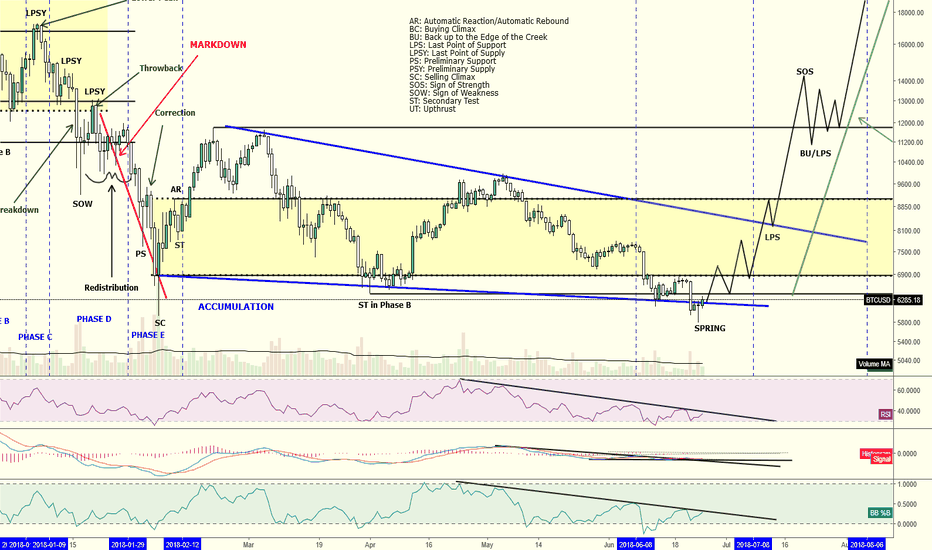

Good morning, traders. Finally, we have a bit of volatility in Bitcoin and the appearance of liquidity engineering. This is the chart I have been working off of for a while now. The volume on this drop has been insignificant compared to the volume on the initial SC drop which is providing support for the theory that this may be the bottom. Remember, bottoms are a process not an event. There are two ways to verify whether an asset is ready for Markup. The most common method which most individuals in crypto look for is the "spring." MM engineers liquidity by selling the asset and pulling support to measure the supply. MM is looking for a low-volume spring followed by an SOS. If the spring is high-volume, then after the AR, we should expect to see price head lower and the subsequent building of a new accumulation area.

Sometimes, however, the test doesn't send price below the TR. This is the schematic that most Tradingview "analysts" fail to know is even available. In this instance, phase C may not appear to be what it is, which throws many analysts off. Those who have been following me in other social media know that I have often provided the alternative narrative that we could see a movement up without the spring test (V-shaped drop and recovery) that the rest of crypto Twitter believes is necessary. If price breaches the $6900 area before breaching the February low, then we are likely to see the recovery without that particular spring. Traders should be watching volume in that case and would want to see it expanding strongly as price recovers. We would need to see price continuing through $7200 to significantly increase the chances of this particular movement out of accumulation.

Daily RSI is showing bullish divergence between June 13th and today. %B is showing the same thing, except starting at June 10th. Watch shorts as they have started building strongly. These shorts are fueling the MM long orders and as price appreciates they will get liquidated causing traders to go long and thereby accelerating continued price appreciation. As mentioned this week, this weekend should give us some direction in the short term at least.

Never forget:

Nothing is guaranteed in trading. TA only provides possibilities, but your analysis of those possibilities provides probabilities. That being said, the only thing you actually control is how much money you lose, no matter how good your entry appears. Therefore, risk management is 80% of trading and the other 20% is the chart. So traders should always define the confirmations they need to see in order to take the position that the probability of any one particular possibility outweighs the others, and then understand that they are most likely wrong which is where the risk management comes in. This is the recipe for successful trading. Treat the market like a casino and it will treat you like a gambler because the "house" always wins.

P.S. Wyckoff schematics are general guidelines. They aren't meant to fit price action into perfectly as most Tradingview "analysts" continue to attempt.

Sometimes, however, the test doesn't send price below the TR. This is the schematic that most Tradingview "analysts" fail to know is even available. In this instance, phase C may not appear to be what it is, which throws many analysts off. Those who have been following me in other social media know that I have often provided the alternative narrative that we could see a movement up without the spring test (V-shaped drop and recovery) that the rest of crypto Twitter believes is necessary. If price breaches the $6900 area before breaching the February low, then we are likely to see the recovery without that particular spring. Traders should be watching volume in that case and would want to see it expanding strongly as price recovers. We would need to see price continuing through $7200 to significantly increase the chances of this particular movement out of accumulation.

Daily RSI is showing bullish divergence between June 13th and today. %B is showing the same thing, except starting at June 10th. Watch shorts as they have started building strongly. These shorts are fueling the MM long orders and as price appreciates they will get liquidated causing traders to go long and thereby accelerating continued price appreciation. As mentioned this week, this weekend should give us some direction in the short term at least.

Never forget:

Nothing is guaranteed in trading. TA only provides possibilities, but your analysis of those possibilities provides probabilities. That being said, the only thing you actually control is how much money you lose, no matter how good your entry appears. Therefore, risk management is 80% of trading and the other 20% is the chart. So traders should always define the confirmations they need to see in order to take the position that the probability of any one particular possibility outweighs the others, and then understand that they are most likely wrong which is where the risk management comes in. This is the recipe for successful trading. Treat the market like a casino and it will treat you like a gambler because the "house" always wins.

P.S. Wyckoff schematics are general guidelines. They aren't meant to fit price action into perfectly as most Tradingview "analysts" continue to attempt.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.