Bitcoin recovering from the Sledgehammer, Fractal or?

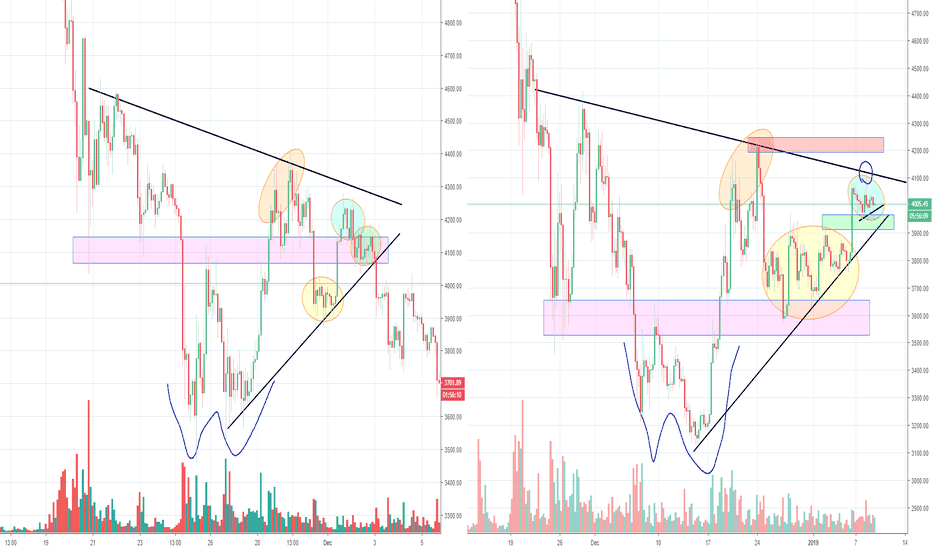

Volume on the dump was not sell-off high but it was high. As the whole market has been doing during the rally, it has done the same with this drop, following ETH'. I wrote a whole story about it in my previous analysis and i will try to do a follow up on that theory if i can find the time. I showed a few options in the previous analysis and so far it has been following this fractal and actually also still following the original chart from the previous analysis. Even though i favored a break up and gave several reasons for it, we broke an important support level (bullish momentum) around 4000/3950 and just dumped big time. Broke the 3800/50 support like a hot knife through butter. Because of the high volume, the size and the break of that support, i mentioned it was likely to see another drop. What i hoped for was however, a smaller drop than the previous one, suggesting a low might be closing in and keeping the higher low pattern alive. But instead we got a similar size drop which is usually a bad sign. A few hours before the drop, i did gave a warning about Bitcoin' and ETH', because of the low volume of BTC' (easy to manipulate but also low buy pressure) and the bearish movement of ETH'. It was just that most of the alts were making (small) breakouts, that things looked quite good. This shows again how important volume is in this game.

I don't like the fact that we dropped to 3500, because that took away the bullish trend the market had build the past month. This because it broke the previous low at 3600 from around Christmas. That red zone on the left, is an important zone to watch. Because IMO that shows the difference between the bulls and bears. If the market is not able to really break that zone, it could become very bearish. So i think a break is necessary to get the pressure off from the bears. Otherwise i am afraid we could see a pattern like we had since the Feb low at 6K. Forming lower highs (11.7K/10K/8.5K/7.4K), showing each time money is flowing away from this market.

Before getting to bearish, that even though my first thought since the 3200 low was a much faster move up to the 4200/5200 levels, there was a more healthier option. This was making a much more solid foundation for the market around the 3200/3500 area. The meaning of this would be, that if we would drop to these levels again, buyers start to enter the market again. So in other words, each time price gets to that range again, an army of bulls show up to buy everything up again. This would be a much better foundation long term than the inverse H&S i assumed at the start of the rally.

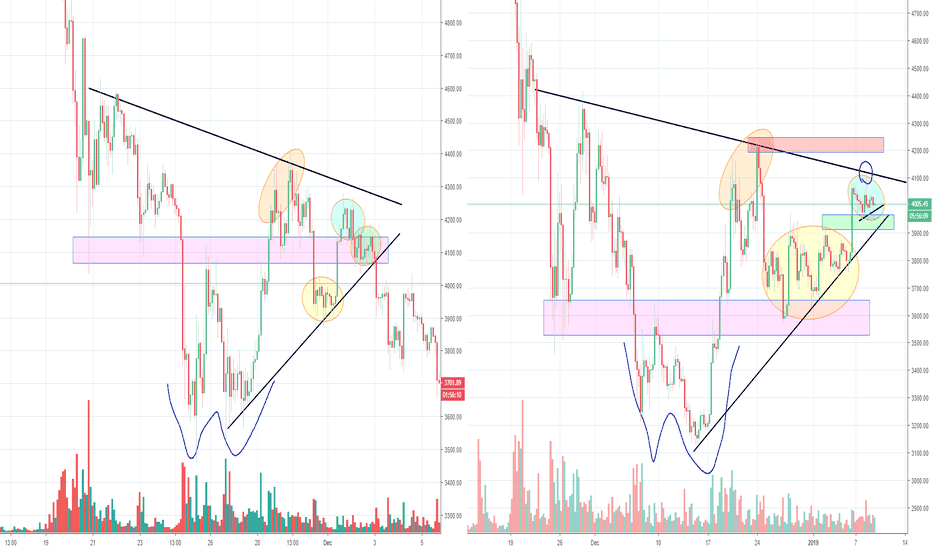

Short term, the blue line on the right is a realistic option. Assuming the current bull flag will fail, since that happens 70/80% of the times the past half half year. If the bulls can keep it above the 3640, it could work out. But i think, even if we get a push up here, we will make a correction down again to test the possible new support at 3500/3600. At the moment i don't have a bigger picture plan, so i will keep watching this from the sidelines until i get a clearer picture. If we get something like the blue line, i will probably get in again. I would keep an eye out on ETH, because the 112/113 is a very important level there. A break of that level, might indicate the bears have taken over again.

As things develop, i will try to give a better indication of the direction for the coming weeks.

Please don't forget to give a like if you appreciate this :)

Previous analysis:

I don't like the fact that we dropped to 3500, because that took away the bullish trend the market had build the past month. This because it broke the previous low at 3600 from around Christmas. That red zone on the left, is an important zone to watch. Because IMO that shows the difference between the bulls and bears. If the market is not able to really break that zone, it could become very bearish. So i think a break is necessary to get the pressure off from the bears. Otherwise i am afraid we could see a pattern like we had since the Feb low at 6K. Forming lower highs (11.7K/10K/8.5K/7.4K), showing each time money is flowing away from this market.

Before getting to bearish, that even though my first thought since the 3200 low was a much faster move up to the 4200/5200 levels, there was a more healthier option. This was making a much more solid foundation for the market around the 3200/3500 area. The meaning of this would be, that if we would drop to these levels again, buyers start to enter the market again. So in other words, each time price gets to that range again, an army of bulls show up to buy everything up again. This would be a much better foundation long term than the inverse H&S i assumed at the start of the rally.

Short term, the blue line on the right is a realistic option. Assuming the current bull flag will fail, since that happens 70/80% of the times the past half half year. If the bulls can keep it above the 3640, it could work out. But i think, even if we get a push up here, we will make a correction down again to test the possible new support at 3500/3600. At the moment i don't have a bigger picture plan, so i will keep watching this from the sidelines until i get a clearer picture. If we get something like the blue line, i will probably get in again. I would keep an eye out on ETH, because the 112/113 is a very important level there. A break of that level, might indicate the bears have taken over again.

As things develop, i will try to give a better indication of the direction for the coming weeks.

Please don't forget to give a like if you appreciate this :)

Previous analysis:

Catatan

There is a decent chance it will move inside this wedge now on the left. If that happens, it will follow the blue line i drew on the right. If the first small red resistance breaks, it could be something else is going on. Above the second one, there is a chance for a bullish movement even. Making the bull flag still valid, even though it has become an ugly one. Just keep an eye on volume if we do move up.Catatan

Still not a lot has changed, was about to break up, even ETH which looked even better. But of course, what a surprise, a big Bart move happened there. So still waiting on the sideline. Ideally we move inside this channel the coming day or 2. If that happens, i might take on a long around the lowCatatan

Still following the path of the blue line, at the end it accelerated it bit more, but that was prob because ETH dumped a lot (it's the new toy of the market btw). Now, i assume we still need to see one wave up, even in the bearish version. Making an ABC, just like we did a month ago on the left.Catatan

Now since we are moving up in decent waves, there are 2 scenario's (assuming the ABC mentioned above is in play.1) We move like the blue line, suggesting a new impulse wave up is starting, but that means we need to get above the red zone without any real corrections. If that happens, there is a decent chance the whole move down was still just a big correction and we will start the second wave up since the 3150 low.

2) We move in correctional waves, suggesting the drop from 4100 a week ago was an impulse wave and this is just an ABC, where we will move up a bit, but only a correction before we continue to crash again. (red line)

Catatan

We are seeing these ugly stop hunt moves again and usually when that happens we see triangles form. Because they are usually correctional moves. During moves like this, day trading sucks, so it's better to stay out, or have a direction and use a wide stop. I still think we should see a wave up, to complete the correction (even in the bearish version), but this triangle could already be it, if we stay inside of it much longer that is. Because corrections don't always need to complete in price, they can also complete in time.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.