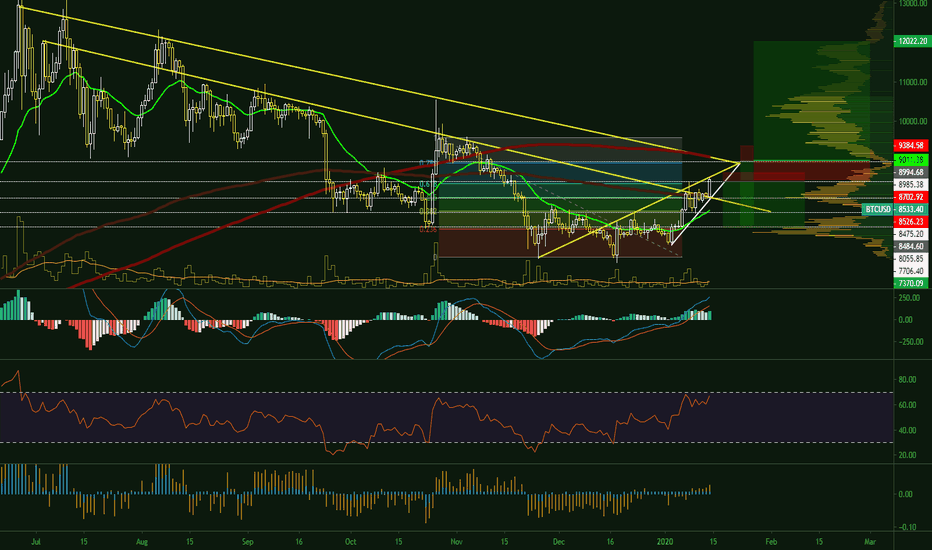

Downwards channel

Short term priority is catching downwards movement until we reach 7600-7350 area or break above 8600.

200 day EMA seems to be providing resistance and I don't see a test of 200 day MA happening yet.

Al trough people are calling breakout of the channel too soon & starting to turn bullish , greed index is still neutral and longs are only slightly overexposed. Which makes shorting around here seem pretty risky.

My best guess (which is not tradable at all, but only serves to make or break my ego;) is a retest of 8200->dump to 7600-7350 area --> false breakout to 8600-9000 area(test of 200 day MA) and then a slow bleed, followed by capitulation to 5k area(200 week EMA&MA support).

Trading this one level at the time and wondering why some bulls are calling downwards channel breakout, I don't see any breakout yet...

200 day EMA seems to be providing resistance and I don't see a test of 200 day MA happening yet.

Al trough people are calling breakout of the channel too soon & starting to turn bullish , greed index is still neutral and longs are only slightly overexposed. Which makes shorting around here seem pretty risky.

My best guess (which is not tradable at all, but only serves to make or break my ego;) is a retest of 8200->dump to 7600-7350 area --> false breakout to 8600-9000 area(test of 200 day MA) and then a slow bleed, followed by capitulation to 5k area(200 week EMA&MA support).

Trading this one level at the time and wondering why some bulls are calling downwards channel breakout, I don't see any breakout yet...

Trade aktif

if it breaks down from here, happy to only be flat usd. If bulls push up above 8600 Ill flip flat into btc with tight sl, in case we break 200 day ma resistance.Catatan

Shout out to Trading V2, who send me pm pointing out the wedge!tradingview.com/u/TradingV2/

Trading ditutup: stop tercapai

Pump ran throug my 8200 short stop, through my cash pos stop and did not enter ether short setup, because pump broke upwards out of wedge. Without pain no gain. Now sitting back and relax in my flat btc pos, put my stop below 8200(prepared to take the loss, but would Hurt). Placed sell bids around 200 Day ma, in case of a pump. If we break throug, ill close it at 200 Day ma support retest or if it runs through my stop.Catatan

Sell bits to open short pos(Will raise sl of btc flat pos in case we reach 200 Day ma)Catatan

Short term plan of catching downwards moves failed big time. Shorting seemed logical, because price was rising into major resistance, but all my stops where run through. At this moment there is no clear sign of direction. Most probable scenario seems to be sideways correction towards support or dump caused by profit taking and trapped FOMO bulls. Lets see if a nice long setups shows itself around the white targets.

In case we keep pumping or growing without a proper correction, my priority is finding a short setup around the yellow targets.

Yelow targets will probably turn white if a correction appears

Catatan

first yellow target on upper resistance should be forgotten, way to riskyCatatan

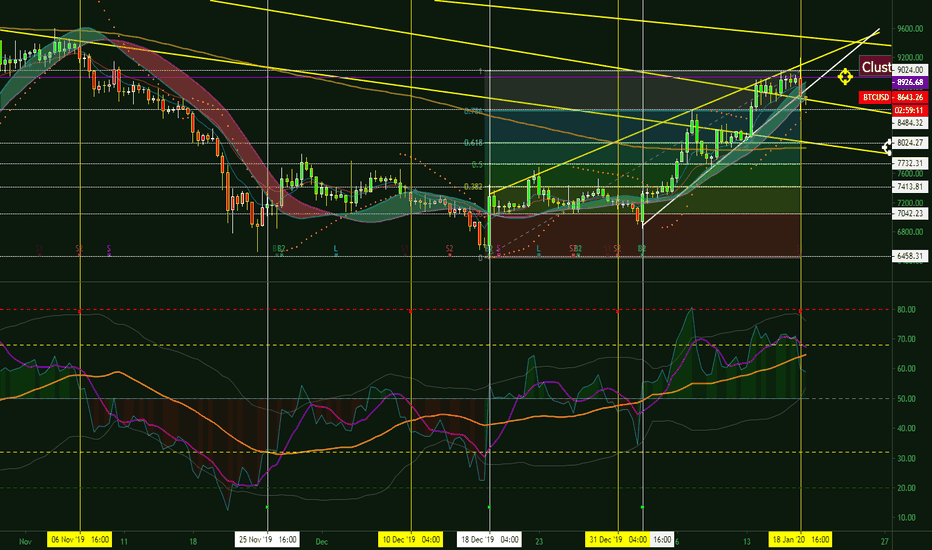

I'm only par time trader, so I have to expose myself to more risk by placing limit orders.Would be way less risky(and profitable) to keep an aye on the chart, wait for break out of the wedge and look for signs of direction to get a better feel of direction.

Get into 30% of position using market order on break out and try to fill rest 70% of position using limit orders aiming at a retest of broken support/resistance.

I'm quite new to trading, but starting to get the basics.

Catatan

Missed out on my short around 9100. Was occupied, having some family time. Deemed the 9100 to risky. Raised my entry to 9450 with stop at 9650. Happy to have missed out on this risky setup (just above 200 day ma). Would have distracted me from enjoying my day.

Did scale out 50% of my spot btc pos. Sold other 50% on basis of signal shown in graph below. New sl 9012

Shout out to tradingview.com/u/TBTS/

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.