📊 Intraday Technical Levels (1-Day Time Frame)

Based on pivot point analysis and Fibonacci retracements, here are the key support and resistance levels for today:

🔹 Standard Pivot Points

Support Levels: S1: ₹709.93, S2: ₹693.88, S3: ₹683.92

Resistance Levels: R1: ₹725.98, R2: ₹732.07

🔹 Camarilla Pivot Points

Support Levels: S3: ₹701.64, S2: ₹703.11, S1: ₹704.58

Resistance Levels: R1: ₹707.52, R2: ₹708.99, R3: ₹710.46

🔹 Fibonacci Retracement Levels

Support Levels: S1: ₹700.01, S2: ₹693.06

Resistance Levels: R1: ₹719.85, R2: ₹725.72

🔹 Woodie's Pivot Points

Support Levels: S1: ₹698.02, S2: ₹692.91

Resistance Levels: R1: ₹708.96, R2: ₹714.08

🔹 Demark Pivot Points

Support Levels: S1: ₹696.92

Resistance Levels: R1: ₹712.98

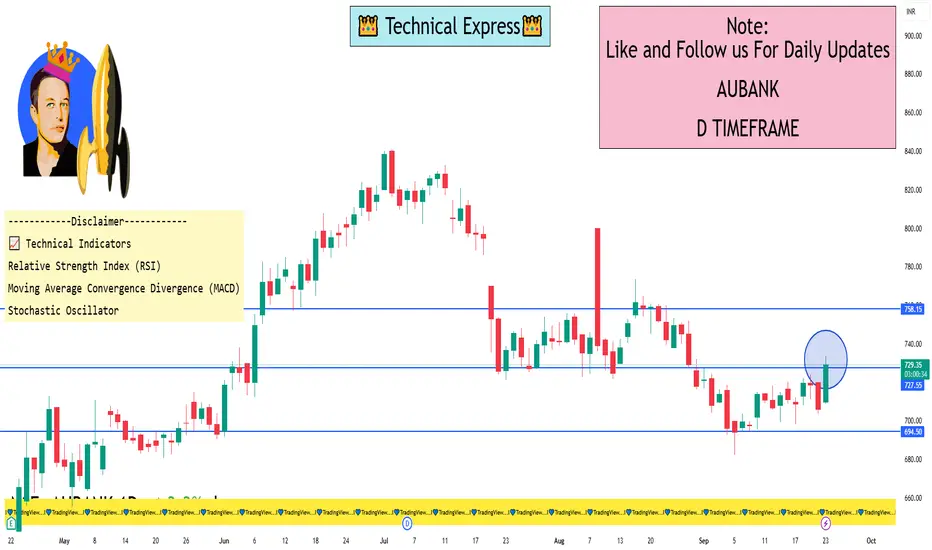

📈 Technical Indicators

Relative Strength Index (RSI): Currently at 60, indicating a bullish trend with room for further upside.

Moving Average Convergence Divergence (MACD): The MACD line is above the signal line, suggesting upward momentum.

Stochastic Oscillator: Reading between 55 and 80, indicating a bullish condition.

🔍 Summary

AU Small Finance Bank Ltd is exhibiting a bullish trend in the 1-day time frame, trading above key pivot levels. The RSI and MACD indicators support this positive outlook. Traders may consider monitoring the stock for potential breakout opportunities above resistance levels.

Based on pivot point analysis and Fibonacci retracements, here are the key support and resistance levels for today:

🔹 Standard Pivot Points

Support Levels: S1: ₹709.93, S2: ₹693.88, S3: ₹683.92

Resistance Levels: R1: ₹725.98, R2: ₹732.07

🔹 Camarilla Pivot Points

Support Levels: S3: ₹701.64, S2: ₹703.11, S1: ₹704.58

Resistance Levels: R1: ₹707.52, R2: ₹708.99, R3: ₹710.46

🔹 Fibonacci Retracement Levels

Support Levels: S1: ₹700.01, S2: ₹693.06

Resistance Levels: R1: ₹719.85, R2: ₹725.72

🔹 Woodie's Pivot Points

Support Levels: S1: ₹698.02, S2: ₹692.91

Resistance Levels: R1: ₹708.96, R2: ₹714.08

🔹 Demark Pivot Points

Support Levels: S1: ₹696.92

Resistance Levels: R1: ₹712.98

📈 Technical Indicators

Relative Strength Index (RSI): Currently at 60, indicating a bullish trend with room for further upside.

Moving Average Convergence Divergence (MACD): The MACD line is above the signal line, suggesting upward momentum.

Stochastic Oscillator: Reading between 55 and 80, indicating a bullish condition.

🔍 Summary

AU Small Finance Bank Ltd is exhibiting a bullish trend in the 1-day time frame, trading above key pivot levels. The RSI and MACD indicators support this positive outlook. Traders may consider monitoring the stock for potential breakout opportunities above resistance levels.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.

I built a Buy & Sell Signal Indicator with 85% accuracy.

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

📈 Get access via DM or

WhatsApp: wa.link/d997q0

Contact - +91 76782 40962

| Email: techncialexpress@gmail.com

| Script Coder | Trader | Investor | From India

Publikasi terkait

Pernyataan Penyangkalan

Informasi dan publikasi ini tidak dimaksudkan, dan bukan merupakan, saran atau rekomendasi keuangan, investasi, trading, atau jenis lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Ketentuan Penggunaan.