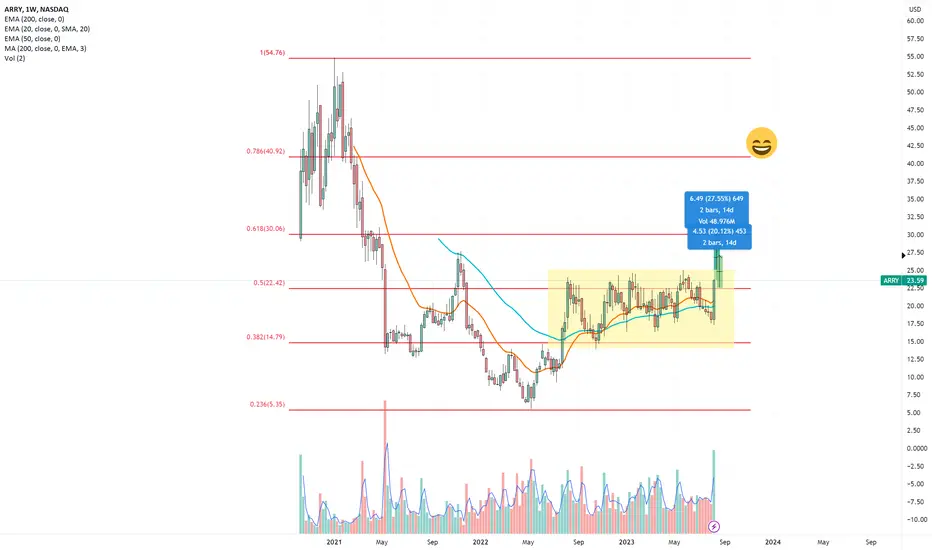

If all other market indicators are not significantly below average,  ARRY appears poised to emerge from a year-long consolidation as a leading supplier of renewable energy components. During the past week, it concluded trading above the 22.43% Fibonacci retracement level. This was a direct result of robust earnings stemming from a well-established global supply chain and a promising future demand for components in Solar Plant Systems.

ARRY appears poised to emerge from a year-long consolidation as a leading supplier of renewable energy components. During the past week, it concluded trading above the 22.43% Fibonacci retracement level. This was a direct result of robust earnings stemming from a well-established global supply chain and a promising future demand for components in Solar Plant Systems.

For further reference, you can check out this link: https://www.iea.org/data-and-statistics/charts/share-of-cumulative-power-capacity-by-technology-2010-2027

It's projected that the ARRY 's price will rise to $30, as numerous investment institutions' analysts have identified it as having potential for a higher trading value than its current level.

ARRY 's price will rise to $30, as numerous investment institutions' analysts have identified it as having potential for a higher trading value than its current level.

Highlighted in green are two strategies for trading

For further reference, you can check out this link: https://www.iea.org/data-and-statistics/charts/share-of-cumulative-power-capacity-by-technology-2010-2027

It's projected that the

Highlighted in green are two strategies for trading

Trade aktif

Early longs taking profits. Some shorts closing trade.Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.