Indikator, Strategi dan Perpustakaan

█ OVERVIEW This Framework allows Pine Coders to quickly code Study() based signal/strategy and validate its viability before proceed to code with more advance/complex customized rules for entry, exit, trailstop, risk management etc.. This is somewhat an upgraded version of my earlier personal template with different strategy used, cleaner code and additional...

This is a strategy adapted initially for Mavilim moving average indicator, based on WMA MA. It seems to works amazingly on long term markets, like stocks, some futures, some comodities and so on. In this strategy, I form initially the candle, using EMA values, so I take the EMA of last 50 closes, open, highs and lows and form the candle After this I take...

Hello, this is both a strategy and indicator that revolves around Heikin Ashi candles. In this case we take 3 different time frames, in this example we use daily , weekly and monthly. The conditions for entry are : For long : we check that we have a green daily candle, at the same time we check that the weekly and monthly candles are also green. For short : We...

This is a powerfull strategy which is made from combining 3 multi timeframes into one for profit max indicator In this case we have daily, weekly and montly. Our long conditions are the next ones : if we have an uptrend on all 3 at the same time, we go long. If we have a downtrend on all 3 of them at the same time we go short. For exit, for long, as soon as...

Sample Strategy: MACD Crossover with trend filter options MA Filter : Price Close Above MA, Search for Buy, Price Close Below MA, Search for Sell ADX Filter : Take trade only when ADX is above certain treshold MACD Signal : MACD Cross above signal line while under 0 line indicate Buy Signal MACD Cross below signal line while...

Monthly options expiration for the year 2021. Also you can set a flag X no. of days before the expiration date. I use it at as marker to take off existing positions in expiration week or roll to next expiration date or to place new trades. Happy new year 2021 in advance and all the best traders.

Swing Reversal Indicator was meant to help identify pivot points on the chart which indicate momentum to buy and sell. The indicator uses 3 main questions to help plot the points: Criteria Did price take out yesterday's high or low? Is today's range bigger than yesterday? (Indicates activity in price) Is the close in the upper/lower portion of the candle?...

Lite version of the original Trendy Bar Trend Color This will only color the candlestick body of your chart Can be used with solid, hollow, renko, or any other chart type Custom coloring for Highs, Lows, and consolidation is removed

Hello, today I bring a swing reversal strategy that work on all financial markets. It uses timeframes starting from 1h, the bigger the better. Its very dangerous because it has no stop loss, neither a take profit. Our exit condition is based on the reversal on the entry . For entry we have 2 types : normal and reversal Lets say we want to go long , for that we...

This is strategy, mainly designed for stock markets It makes uses of the EMA 50/ 200 ( Golden cross) and VWAP and Bollinger bands. It only takes long positions. It can be adapted to all time frames, but preferably to be used with longer timeframes 1h + The rules for entry are the next ones : 1. EMA50 > EMA 200 2. if current close > vwap session value 3. check...

Hello there, Today I bring you a stock market strategy, specialized in NASDAQ stocks. Its a daytrading strategy, that can only do a max of 1 trade per day. In this case it only trades the first 2 opening hours of the market. The rules are simple : We follow the trend based on a big EMA, in this case 200, after that, we check for VWAP direction , then, we...

This is a strategy made from ichimoku cloud , together with MACD, Chaiking Money FLOW and True Strenght Index. It can be adapted to any timeframe and any type of financial markets. The idea behind its very simple, We combine the long / short strategy from ichimoku, like cross between lines and below/above cloud together with histogram from MACD for...

Simple "benchmark" strategy for ETFs, Stocks and Crypto! Super-easy to implement for beginners, a DCA (dollar-cost-averaging) strategy means that you buy a fixed amount of an ETF / Stock / Crypto every several months. For instance, to DCA the S&P 500 (SPY), you could purchase $10,000 USD every 12 months, irrespective of the market price. Assuming the...

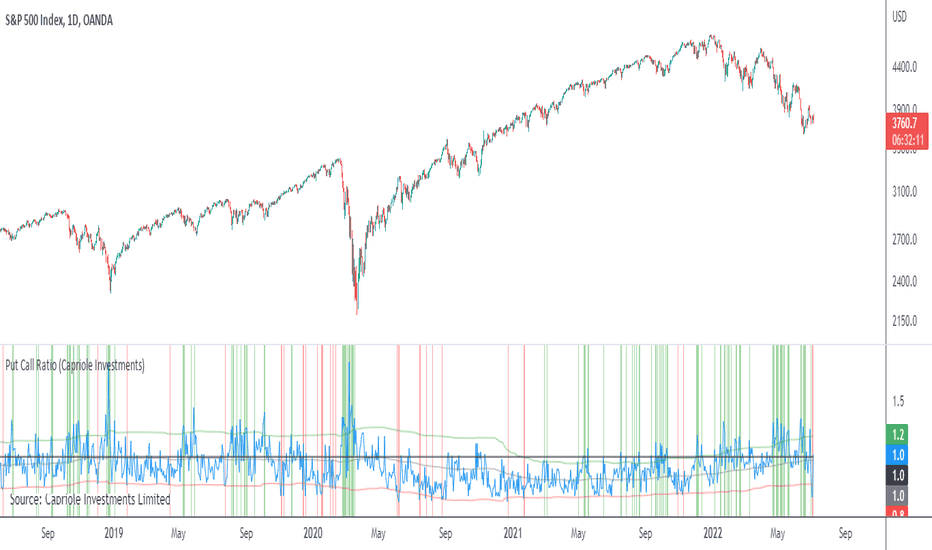

Plots the CBOE Put Call Ratio and marks up locations of extremities. Useful as a factor of confluence in identifying extremities in the market.

This indicator is very simple, but surprisingly effective, and I haven't found any mention of something similar, so here it is. I hope it helps you in your stock trading. Someone made a comment in a trading room that the 8 am candle of the stock looked odd, so I quickly checked all the other stocks I had on my screen, and for all of them, the 8 am candle was...

While trading, I noticed that emphasis is often placed on how far price has moved from the moving average (whichever a trader prefers). In these cases I also found that Bollinger Bands only sometimes played a factor in determining whether price had moved "too far" from the moving average to potentially result in a sharp move back to the average. Because I wanted...

Source: Stocks and Commodities V38 Hooray! Another new John Ehlers indicator! John claims this indicator is lag-less and uses the SPY on the Daily as an example. This indicator is a slight modification of Reflex, which I have posted here I think it's better for Stocks and ETFs than Reflex since it factors in long trends. It tends to keep you in winning trades...

Source: Stocks and Commodities V38 Hooray! A new John Ehlers indicator! John claims this indicator is lag-less and uses the SPY on the Daily as an example. He states that drawing a line from peak to peak (or trough to trough) will correspond perfectly with the Asset. I have to say I agree! There is typically one bar of lag or no lag at all! I believe this...

![[fareid] Quick Backtest Framework EURUSD: [fareid] Quick Backtest Framework](https://s3.tradingview.com/d/DTYsoEN1_mid.png)