Technical Overview

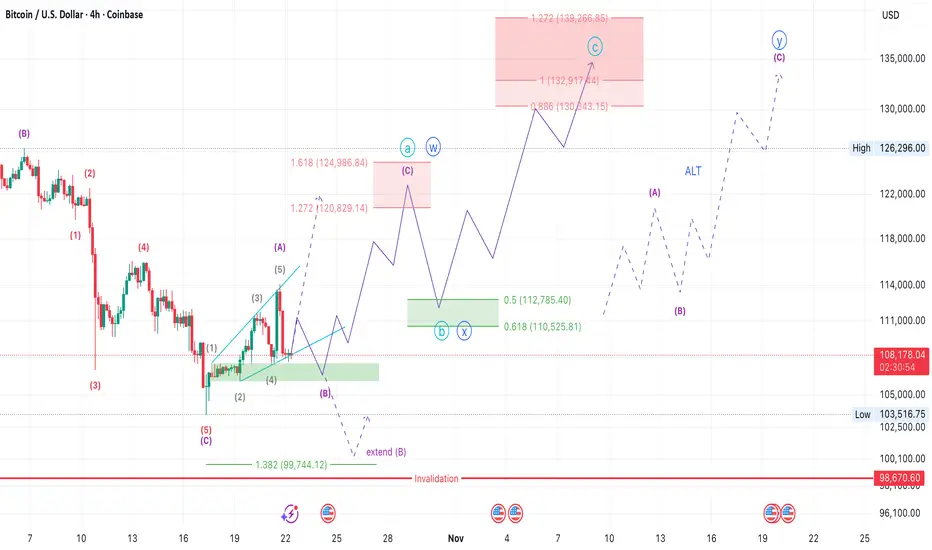

Bitcoin appears to be developing the final micro-structure inside Wave 5 of a larger ending diagonal pattern, which aligns with the broader weekly count.

After the recent low near $103500, price began forming a corrective rise that may represent wave ABC OR WXY of the final push to complete the terminal pattern.

The current 4H projection suggests that BTC will building subwave (C) within a potential W–X–Y structure. The next impulsive move could lift prices toward $130K–$139K, completing the upper boundary of the diagonal before a major reversal begins.

Key Levels:

Summary:

BTC is in the final phase of an extended ending diagonal, likely completing wave (5) of (V).

The short-term setup remains bullish toward 130–139K, but traders should prepare for a major macro reversal once that zone is reached.

Momentum divergences and weakening volume will be key confirmation signals for the top.

Bitcoin appears to be developing the final micro-structure inside Wave 5 of a larger ending diagonal pattern, which aligns with the broader weekly count.

After the recent low near $103500, price began forming a corrective rise that may represent wave ABC OR WXY of the final push to complete the terminal pattern.

The current 4H projection suggests that BTC will building subwave (C) within a potential W–X–Y structure. The next impulsive move could lift prices toward $130K–$139K, completing the upper boundary of the diagonal before a major reversal begins.

Key Levels:

- Support / Buy Zone: 106 – 107k

- First Target: 120 - 124k

- Main Target Zone: 130 – 139k

- Invalidation: Below 99,744 (1.382 Fib level) which will invalidate the idea of extended wave B

Summary:

BTC is in the final phase of an extended ending diagonal, likely completing wave (5) of (V).

The short-term setup remains bullish toward 130–139K, but traders should prepare for a major macro reversal once that zone is reached.

Momentum divergences and weakening volume will be key confirmation signals for the top.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.

Pernyataan Penyangkalan

Informasi dan publikasi tidak dimaksudkan untuk menjadi, dan bukan merupakan saran keuangan, investasi, perdagangan, atau rekomendasi lainnya yang diberikan atau didukung oleh TradingView. Baca selengkapnya di Persyaratan Penggunaan.